Big Data Usage in Climate Risk Modeling: Insurance Tech Trends (6)

Data is changing the way we live our lives. We use it to calculate the calories we eat and how many steps we take in our health apps. While it might not be so obvious, data is being used to tempt us to buy stuff while we browse online. There is data doing quick computations as we check routes with the least traffic or look at weather predictions for the holiday we are planning. When data is behind so much of what we do, it is no surprise that big data will have its biggest impact on climate change predictions. This brings us to the sixth of the major tech trends defining insurance in 2022: Climate risk modeling.

Why Climate Risk Modeling is taking center stage

The insurance industry is a critical contributor to the US economy overall, contributing to over 3.1% of GDP. US insurance companies wrote approximately $1.32 trillion in premiums in 2021, up from $1.28 trillion in 2020 (Source: NAIC data). While the industry is an essential service after an unfortunate event, they are also major institutional investors with a significant influence on financial markets. That is why every insurance business, no matter its size, will be impacted by climate risk both across the economy and its insured policyholders. Big data and climate risk modeling are becoming invaluable as a technology trend in this scenario.

The increased frequency and severity of wildfires, floods, and the recent unprecedented heatwave in America and Europe, emphasize the physical risks of climate change. These climate-related events are causing significant losses for the insurance sector and are a sign that the price of inaction can have a far-reaching effect not just on a human level but also on financial losses for industries.

According to theApril 4, 2022, Intergovernmental Panel on Climate Change (IPCC) report, insurance payouts for climate-related catastrophes have “increased significantly” over the last 10 years, a trend that is expected to continue.

Insurance companies have long used varying techniques to assess risk profiles across various criteria and dimensions, however, until now climate risk has had a small part to play in these risk models. US state regulators and lawmakers are becoming increasingly concerned with the slow response from the insurance sector on disclosures related to climate risk. With that being said, the Securities and Exchange Commission (SEC) is drafting rules related to climate-related financial disclosures.

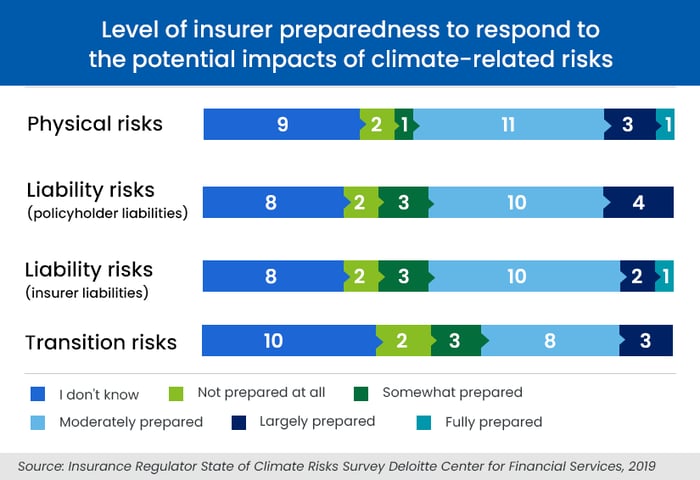

Insurer preparedness is becoming vital for keeping up with probable new mandates. Yet according to a Deloitte survey, insurers have not done enough to gain regulator confidence:

-

One-third of responding regulators said they are not sure if insurers are prepared to deal with the potential impacts of climate-related risks on financial stability.

-

One-third of the regulators surveyed were doubtful that the current insurer risk models would be able to capture and test climate-related risks.

Future-focused insurers are realizing that climate risk mitigation strategies need to be built into their business models. This realization is not just because of regulatory mandates but also because companies have access to a growing number of tools that model climate risks. These tools will help insurance carriers to shape their risk management strategies. New data sources such as satellite data, remote sensors, weather station reports, social media listening, ESG models (environment, social and governance criteria), water levels, etc. will provide accurate, real-time risk information. All these information streams tie into a single term: Big Data.

Defining Climate Risk

Climate risk is a broad term that encompasses 3 elements

1. Physical risks:

These arise from weather and climate-related events such as wildfires, floods, and rising sea levels caused by global warming and melting ice caps (a worrying 7 inches increase in the last 2 decades). Even in the most optimistic scenarios, these are irreversible and their impact can be seen in higher mean temperatures and their effect on agriculture and disease transmission. As the frequency of such events increases, insurers’ risk modeling and premium assessments will have to be continually updated.

Catastrophe modeling tools or Cat models such as AIR Worldwide or RMS, combine modeling a catastrophe footprint and linking it with insurance business processes. Computer-assisted calculations and simulations can estimate potential losses at a given location from an event such as a hurricane or an earthquake. It brings together actuarial science, engineering, meteorology, and seismology and is integrated with big data analysis. These proprietary tools are provided by vendors such as IBM but open-source climate change models based on industry-wide cooperation are also becoming available. From the perspective of the insurance sector, these are invaluable to price risk and determine capital requirements.

2. Transition risks

This covers the risks associated with attempts by companies and societies to adjust to a low-carbon economy. In such a transition, prior investments may lose their value, known as stranded assets. Transition risks might also arise from changing policies such as a carbon tax or because of changing consumer behavior toward companies that have a poor record concerning the environment and communities.

The International Energy Agency (IEA) has estimated that a shift to a low-carbon pathway could cause a USD 10 trillion loss in stranded assets in high-carbon sectors by 2050.

The uncertainties that are part of transition risk (policy, legal, technology and market risks) make it difficult for insurers to effectively arrive at an accurate climate risk assessment for all aspects of the insurance business model. Much more work is required to arrive at robust methodologies.

3. Liability risks

Physical risk is the most advanced of climate risk modeling this far. However, legal liability exposure arising from a company’s business activity is still an unknown area since there has been limited litigation related to climate risk. For instance, people or businesses that have suffered from a climate catastrophe and made claims against organizations that they see as responsible for contributing to climate change. Although climate litigation has been mostly against governments in the past, litigation against companies could see a rise.

U.S. insurance supervisors are taking climate risks very seriously. To mitigate liability risks, companies will be advised to meet climate-related risk disclosures set by the Task Force on Climate-related Financial Disclosures.

While insurance carriers may be at different stages in their climate risk modeling process, the challenges they face are the same: Identifying physical and transition risks exposures on assets and liabilities. Translating climate change predictions into financial variables and finally developing mitigation plans. While this is a long journey, 2022 marks the trend of climate risk prediction models growing stronger, more refined and more site-specific, generating greater confidence in the prediction models.

Has this tech trend got you curious? Here are the other technology trends in insurance that we have written about:

-

Intelligent automation in core functions

-

Collaboration with ecosystem players

-

CARE-based digital tools for improved CX

-

Chatbots that will take over 95% of customer conversations

-

The growth of usage-based insurance models

-

Big data usage for climate risk modeling

-

Incorruptible blockchain data

Topics: Digital Transformation