Drone Usage in Insurance is Taking Off, Can Your Platform Support It?

.png)

To see one of the latest innovations in insurance technology, you might want to turn your gaze upwards, towards the skies. Unmanned aerial vehicles (UAVs), more commonly known as drones, offer insurers a faster and more accurate way of analyzing data with minimal human risk. Several insurers have already experimented successfully with drones in risk assessment and claims settlement.

An interesting statistic is that the insurance industry in the United States accounts for around 17 percent of all commercial drone usage. - Source FAA

In today’s climate where the focus is on minimal human intervention, this number is projected to increase significantly. However, while drones in insurance can undoubtedly reduce costs in the long term, they do require a substantial investment in the short term. This is not just in terms of the cost of home inspection drone technology, but also the time and effort required to switch from traditional claims inspection and to train staff on the change. The biggest consideration though is whether existing insurance platforms can support integration with solutions provided by external partners in an open ecosystem.

What is an insurance ecosystem?

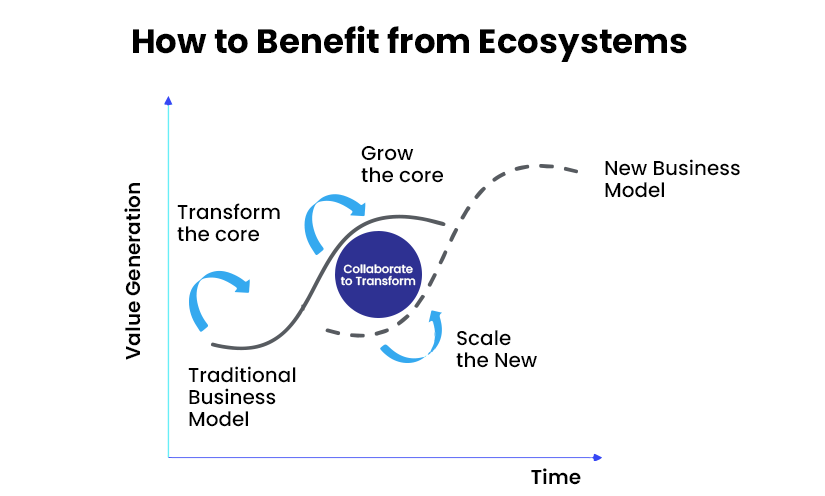

An ecosystem in the realm of insurance specifically refers to an integrated experience resulting from multiple providers working together in an interconnected system. This network of players may be either from inside the industry or out but each brings a specific capability. The power of such a system is defined by its complementary nature. In such an ‘open insurance’ model, none of the players can by themselves operate all aspects of the solution but by coming together they create an ecosystem that is more valuable than each player on their own.

Drone usage is a good example of such an open insurance ecosystem. Most insurance carriers using a drone strategy are bringing in outsourced drone solutions and integrating them with their in-house claims and underwriting solutions.

Since drones require less manpower on the ground, they are a cheaper alternative to on-site inspections. This means that adjusters can spend more time on qualitative analysis and decision-making rather than on data collection.

By some estimations, drones can collect data 10 times faster than traditional methods and can result in a 40 percent increased efficiency.

While drones are increasingly becoming popular among insurance carriers for their immense ability to collect real-time imagery, a manual operation can only go so far. Automated drone flights along with AII and analytics software are helping digitize the entire claims process. It is important to bring in a caveat here, while intelligent software will help to quickly provide data insights, skilled adjusters will be needed to interpret and act on the data.

Can your insurance platform support drones?

Making the shift from traditional assessment and claims processes to drone technology can be a drastic change. Drones operate within the largest insurance ecosystem. The success of the ecosystem depends upon how in sync all the integration solutions and platforms are. In the context of drone technology, footage from drones needs to be combined with mobile platforms that enable remote control over them, AI technology that can interpret footage, and a cloud-based system to host it in. Therefore, before including drones in your claims inspection process, you need to ensure that your existing platform has these technological capabilities. All the different cogs in the solution will need to talk to each other through the medium of application programming interfaces or APIs. Does your insurance platform support APIs?

Apart from checking if your insurtech platform supports home inspection drone usage, it’s important to ensure that the actual drones used, adhere to guidelines. According to the Federal Aviation Administration (FAA), drones need to meet the following requirements:

-

They shouldn’t weigh more than 55 lbs

-

They should fly within a visual line-of-sight

-

They cannot fly higher than 400 feet above ground level

-

Flying drones should be restricted to within daytime or twilight

-

The speed of drones cannot exceed 100 mph

Software requirements for drone integration

Apart from the FAA guidelines, insurers need to take steps towards managing and protecting their drone fleet. Some of the software requirements to successfully manage and scale your drone fleet include:

-

Partner with a drone platform: Flying drones over inaccessible locations is only one-half of the picture. A drone technology platform can help automatically detect damages, take measurements of a property and generate automated reports. Apps provided by drone providers allow adjusters to pair their drones with the platform through a simple invite link. These apps can then capture footage in real-time and store it on the cloud. Adjusters can then closely inspect the footage, tag it and create automated custom reports.

-

Manage data in cloud-based software: You need to maintain complete records of your drones on the cloud. This includes details on their specifications, maintenance records, inspection dates and records of their usage. Storing this data on the cloud ensures that it’s easily accessible, something that isn’t possible with paper-based records.

-

Mobile-first platforms to control usage: One of the biggest priorities for insurers when managing drone fleets is to gain full visibility into their usage. Insurers need to know the exact location of each drone, where it is deployed, and what purpose it is being used for. A mobile application makes it easy for employees to update drone usage information in real-time from any location. Most drones also come with a GPS tracking feature that can automatically transmit location data through the mobile app.

The challenge is to integrate the data collected into the company’s core insurance platform as seamlessly as possible and be accessible to not only claim adjusters but also underwriters, brokers, and reinsurers.

This is where SimpleSolve steps in. The decades of experience in insurance have ensured the company keeps evolving its state-of-the-art platform, SimpleINSPIRE that easily integrates with emerging technologies and services. SimpleINSPIRE, while having an integrated, highly automated core system as its base, is also designed for collaboration.

This is the reason why CIOReview has listed SImpleSolve as a top insurance technology innovator in 2021. Quoting from the article -

SimpleSolve has created an API layer where its platform becomes the host to a greater insurance ecosystem with an integrated workflow shielding its clients from having to invest in multiple integrations and services, yet able to take advantage of emerging technologies. - CIOReview

If you would like to know how to improve your insurance platform to power it with the ability to integrate or collaborate with partners for emerging technologies, sign up for a custom demo with our insurtech professionals.

Topics: Legacy System Modernization