The Importance of System Architecture to Shorten Customization Time

It is not difficult to find a correlation between software architecture agility and operational benefits. In a competitive landscape where disruptive technology is constantly pushing the barriers, time-to-market can be the big differentiator.

Insurers who lack a robust tech stack with the right software architecture, integration layer architecture and platform integrations can find themselves struggling to offer the best digital capabilities. For instance, a BCG report has found that 35% of all insurance industry applications are not “cloud ready”, making them incompatible with mobile devices - modern consumer’s device of choice.

Software architecture is the foundation that builds the system

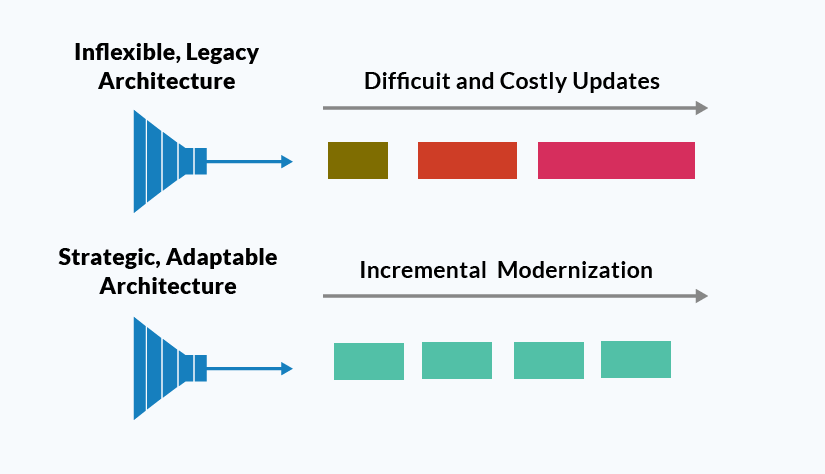

Many insurers have legacy architecture that is older than the engineers working on them. Making even small changes to these monolithic core systems, require months of regression testing.

Moving to a modern architecture requires a fundamentally different approach where core systems are “loosely coupled”. Components interact with each other via APIs but have a developmental and operational independence that allows for upgrades on one component without having to spend months on regression testing all components.

Also Read: P&C System TCO – What Are All the Factors in Figuring This Metric?

Modern software architecture layers

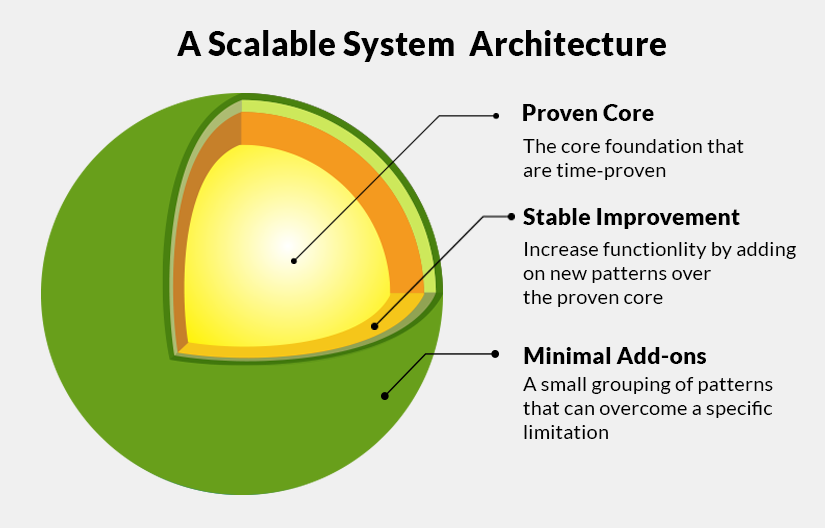

Modern designs are built on many different layers that serve different functions. While some layers can be plugged in along the way, the big architectural decisions need to be decided right at the start. For instance, choosing the central technology stack that will underpin your entire tech system needs to be decided upfront. Here’s how to consider your architectural outlay:

-

System Layer

The basic tech stack or the centralized system that connects different applications and interfaces forms the base of your system. An interlinked core system will mean records, information and processing will be faster. This is the core that needs to be decided and maintained over time.

-

Process Layer

The process layer is the structure that establishes how effective the delivery of different software features will be. Choosing an architecture that allows data to interact well and quickly-enough is important. For instance, the application used for the purchase order process should be able to draw from the information in other products or services. This could be his could be when an order is created, it automatically updates the accounting system. Or an integration scenario might require it to a third-party service to allow it to accept invoices from vendors.

-

Experience Layer

The experience layer of a software outlay is one of the most vital components to consider. It lays down the basics for how data is processed or consumed across channels. Take for instance an API experience layer. It will allow developers to add certain functional layers while still relying on some of the core components that have been established as part of the system later.

-

Network Layer

Network layer is responsible for data transmission. It ensures that your applications and services run smoothly and on-time. A cloud layer, for instance, can ensure that insurers never lose vital information and data transmission is fast at all times.

All of these different components will come together to bridge any gaps that there may be in your digital functionality as a whole. A seamless cradle-to-grave connectivity will help improve their speed-to-market as well as glean their competitive edge.

Spending time to choose the right digital foundation, focused on high quality and important elements, will show benefits within weeks, according to experts. Choosing the right tech stack and foundational core of your system during its initial development will ensure that future roll-outs are faster. There will be fewer glitches to hold you back.

Also Read: Also Read: What’s Keeping Insurers from Using Insurtech More Effectively?

Making the right choice to reduce customization time

Many times, insurers think turning to mainstream biggies for their tech needs is the only way to go. However, you do not have to spend an arm and a leg to keep your dominance in the market through more agile solutions. Insurtech providers like SimpleSolve provide proven and efficient solutions that enable you to compete with the giants.

Choosing the right system architecture for your digital insurance interface requires considering the trade-offs between:

- Flexibility

- Scalability

- Performance

- Speed

These are especially important elements to consider when you want to launch new insurance products and cut the time-to-market. Finding a software architecture design that at least largely satisfies these requirements is a good starting point.

To keep pace in today’s world, insurers need to look to software architecture designs that are based on both microservices architecture and cloud-based architecture.

-

Microservices architecture is flexible and scalable, which will allow more features and pages to be added to your application without hassle. Since this software design is organized around business capabilities rather than application specifications, it can help with quicker customizations and shorter time-to-market.

-

Cloud-based insurance architecture that is backed by AI and data analytics allows for secured integration across applications, stakeholders in the ecosystem such as business partners, service providers or regulatory institutions as well as customers. It has scalability, security and agility that can improve customer experience.

For instance, MetLife uses a cloud service insurance platform to provide a 100% digital experience for its home and auto insurance clients in the US. Backed with data and analytics, the cloud software design has allowed MetLife to assess risk and pricing within minutes. In turn, it allows customers to buy policies online more quickly. This has made MetLife’s MyDirect product just as competitive as what some of the new-age insurtechs are offering customers.

When launching a new insurance product or feature, your system architecture needs to be robust enough to support a successful launch. Many times, insurers find it challenging to be quick on their feet when it comes to innovation and customization. The number one reason for this is often a poor architectural decision. This is why choosing the right one for your needs is imperative.

How SimpleSolve Tech Stack Architecture helps

SimpleINSPIRE is the enterprise insurance software that is built by insurance professionals for the insurance world. It’s a full-integrated, microservices-based platform designed to be future-ready! From smart automation to Business Intelligence, SimpleINSPIRE’s software architecture can support all your productivity, scalability and top-notch customer experience needs.

Topics: System Architecture

.jpg)

.jpg)