Insurance Mobile Apps – Expediting the Quote Process

Mobile apps practically rule our lives today, changing the way we do things and the way we connect with people. Insurance providers know the importance of having an app if they want to reach mobile-oriented customers. This awareness is why new insurance apps are making a more frequent appearance on the market today than a few years ago. Insurance carriers are realizing their benefits in the form of a faster quote mechanism, lower costs and higher growth.

There is no one-size-fits-all insurance app

Cristiano Ronaldo has insured his legs for a whopping $144 million. Actress/singer JLo has taken a 27 million dollar policy for her butt. It’s not just mega stars though, the soon-to-wed are also taking out wedding insurance because the price of a wedding can cross an eye-popping $34,000 and that does not include the honeymoon. While most customers do not fall into the megastar or special occasion insurance bracket, the point here is that there are varying types of insurance policies and different quote mechanisms for each.

This is why insurance apps can be pretty tricky for insurance providers whether they are in health insurance, property, travel or auto insurance. While each may require its own app features, there is still a common thread running through - all insurance companies have to provide quotes. There are three actors in the insurance business and each might need its own app interface. These players are:

-

The insurer (the insurance company and their agents)

-

The insured (the person who takes the policy), many of them shopping for insurance online

-

Providers whose services are covered by the insurance such as doctors in health insurance or car repair services for auto insurance.

When building an app, insurance providers will have to weigh the pros and cons of having a combined app for all three players or different apps for each. Obviously, a combined app will be much heavier and take up much more space on a mobile device as well as require more processing power.

If you split the app into 3 connected but separate apps for each player then more features can be added and it will simplify the process for each role. The downside is that developing 3 different apps will require more time.

There are workarounds that could be considered. A service provider app can be skipped, if you don’t mind still dealing with paperwork for service claims. If your agents are not in the field, then instead of an agent mobile app, you could build a web app. While 3 individual apps are the best route to go with, the pros and cons need to be weighed carefully if choosing one or the other option.

Insurance quoting software has brought in real-time data

Generally, insurance customers do not have very complicated needs, they just want to be given the ability to choose from a selection of policies with the most competitive prices. The more complicated the rate the more likely a customer will want to speak to an agent.

Insurance quoting software is a computer program that makes it possible for insurance companies to automate the insurance quotes online process. It is also the technology that is powering insurance agents and brokers to provide customers shopping for insurance with multi-carrier quotes. It helps agents to drastically cut down the time spent on each individual inquiry and rather spend more time on converting confirmed interests into actual customers.

The quote engine cuts the time it takes to generate multi-carrier quotes down to less than 60 seconds.

Quotes are just an approximate estimation of what a specific type and brand of insurance will cost them. Traditionally, insurance agents would provide a custom quote by first obtaining endless personal details through a lengthy phone conversation with the customer. They would then calculate the quote by comparing the company’s average insured’s cost for the specific insurance type and then compare it with the specific customer’s need and then finally arrive at a premium. It might also involve in-person visits to the agent’s office to fill out forms. Cut to the scenario today: The customer fills out a few details in an online search form and related policies and quotes are thrown up in a competitor analysis format. The customer chooses the ones that appear most relevant and then quickly gets into a finalization process, which may or may not require human intervention. The biggest benefit is that self-servicing portals and apps provide the quoting feature 24/7.

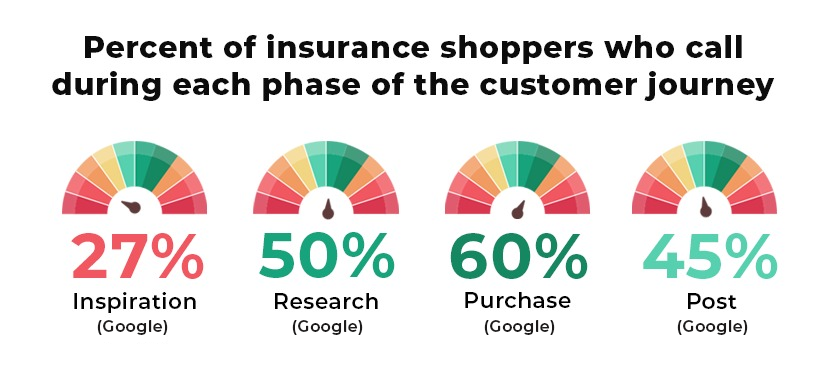

Every insurance provider or MGA needs an app for quoting premiums and the statistics bear it out. Insurance queries that have the search phrase “insurance near me” have grown over 100% in the last 2 years according to Google insights. Over 68% of online insurance shoppers do not have a specific company in mind when they start searching.

69% of insurance consumers first search for suitable options before scheduling an appointment. Agencies that don't use a mobile app run the risk of losing business. (Source: LSA)

Quoting software for personal and commercial line insurance

The prime purpose of an insurance app is to streamline the agents’ process and improve customer experience. Insurance agents who sell P&C insurance are often working with customers who need various policies for different needs. A quote and enroll software enables agents to pull plans for different products and quote them to potential clients in much less time (even if the process is not fully automated for self-servicing).

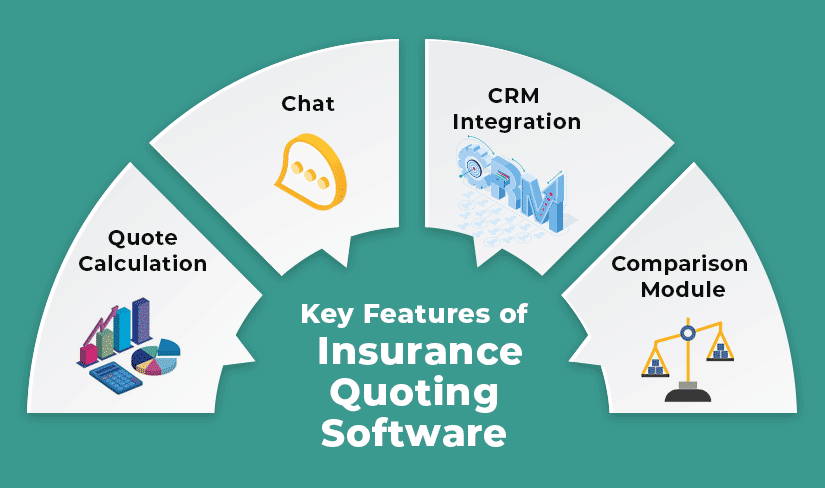

Insurance quoting tools usually have core features like calculators, option comparison, chat (often automated chatbots) and customer service management. While the features are the same, they are also different insurance quoting software specialized for different products.

For instance, commercial quoting tools can only be accessed by agents and not the end customer/business. Commercial coverage has much more complex questions and often needs customized quotes worked out, based on instant data through the quoting mechanism. Businesses across different industries have different industry and organizational risks. It is a tough ask for agents to maintain up-to-date information for each industry. Commercial quoting software makes this much easier.

Personal lines insurance (auto, renter, homeowners and travel insurance) has a quoting mechanism that allows for a self-service method. Speed is often a prerequisite here. For instance, when financing a car, customers are required to purchase collision coverage which can be expensive. A quick comparison analysis of price, terms and services can help them quickly hone into a policy that suits their budget.

Efficiency is key

Whether personal or commercial line insurance, the reason why agents are adopting quoting applications is efficiency. Previously every carrier had its own set of questions and this meant agents had to manually enter and re-enter questions and send them to different carriers to get a quote. It was both inefficient and time-consuming. The modern quoting tools can enter answers for a set of common questions, hit a submission button just once, and have it populate in individual carriers’ quoting systems.

There is one hurdle for some insurance carriers to adopt this methodology. It boils down to the fact that modern tools work on APIs and carriers who haven’t got APIs integrated with their platforms will find themselves on the back foot. Many insurance companies are also using sophisticated data mining software to help them set their rates. It provides more precision in risk-based pricing.

In short, digital transformation needs a microservices-based architecture for its core platform that can feed necessary APIs that connect to the insurance ecosystem. SimpleSolve’s ecosystem approach offers our customers 70+ game-changing APIs that can be made available on demand or rapidly composed or deployed. This is an unmatched ability that is helping our clients to gain market leadership through innovative products that create sustainable value. Kickstart your journey by asking us for a demo.

Topics: Mobility Applications