Think of modern insurance platforms like the engines in a fleet of cars. Some have the horsepower to accelerate swiftly, much like a sports car, while others chug along at a steadier pace, like a compact sedan. It is all about choosing the right 'engine' that aligns with your business's needs while being sure that it delivers on the ‘ROI Acceleration’ you expected when you migrated to the new insurance platform.

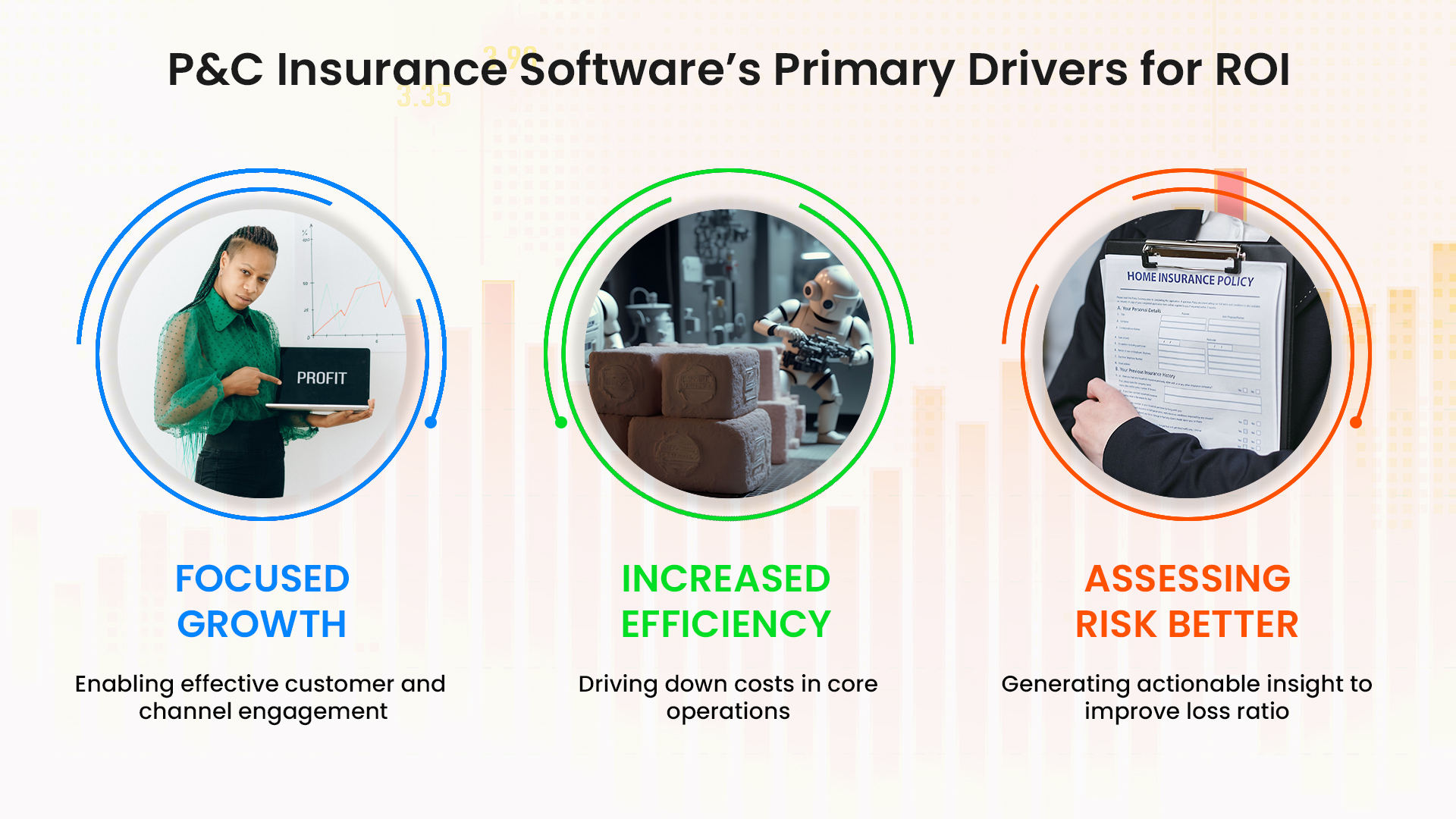

During our discussions with numerous senior leaders, we find that they often look at technology as competitive disrupters rather than how their digital investments will yield ROI and reduce their operational costs. Digital transformation is a top strategic priority and insurers expect their insurance software to automate, manage, and streamline diverse business processes. However, there are critical distinctions that elevate certain insurance platforms as transformative agents.

Scaling Agility Must be the New Operating Model for Insurers

The insurance industry cannot wait for IT to catch up with their business plans. They need an insurance platform that provides the tools to roll out changes quickly. Insurance software is considered to be both agile and scalable only if it can swiftly respond to dynamic market conditions and evolving risk landscapes.

An example is dynamic underwriting. Unlike traditional systems that may struggle to adjust underwriting models promptly, an agile and adaptable insurance core platform will have real-time data analytics and machine learning that together will reduce the time to make the change. For instance, when faced with a sudden surge in claims related to a specific type of cyber threat, the software can rapidly analyze and incorporate this information into its underwriting algorithms. This adaptability ensures that insurers can proactively manage emerging risks, adjust pricing strategies, and be aligned with market trends.

The adaptability of P&C insurance software extends to multiple scenarios. Consider a sudden change in regulatory requirements – a highly common occurrence in the insurance industry. An adaptable software system can swiftly apply these changes to its processes, ensuring compliance without the need for extensive system overhauls.

A quick sign that your insurance platform is scalable is if it can handle an increased workload without compromising performance. Look for platforms with proven scalability metrics, such as the ability to process a high volume of transactions or quotes daily.

SimpleINSPIRE's insurance platform has a proven track record for scalability with over 15,000 quotes processed daily with minimal performance degradation.

Calculating Return on Investment (ROI) for Agility and ScalabilityNet Gain = (Revenue Increase from Faster Time-to-Market)−(Cost Savings in Operational and Downtime Costs) ROI= (Net Gain / Cost of Investment) x 100 |

In today’s digital world, software agility is business agility. Calculating the ROI of the agility of your investment will depend on various factors such as industry benchmarks, organizational goals, and the functionality of the software itself. A realistic target might be a 10-20% increase in ROI over a specified time frame, this could be between 12 months to 24 months depending on the extensiveness of the integration.

Also Read: New Policy Management Software: The guide to getting it right

The Crucial Role of Customer-Centric Features in an Insurance Core Platform

While it's true that every modern insurance platform emphasizes customer-centric features, the effectiveness of these features can vary. What sets the right insurance platform apart is often determined by the depth, sophistication, and practical impact of its customer-centric approach.

It is not just personalized policy decisions but it should also extend to the platform's ability to enhance the overall customer journey. Customers do not want to jump through hoops to get a quote, they also want the tools to manage their risks. All this needs the right technology

The new insurance core platform must integrate advanced analytics to provide customers with personalized policy recommendations based on their unique needs. It must have APIs (Application Programming Interfaces) to seamlessly integrate with external systems, partners, and emerging technologies. Advanced platforms will provide a constantly expanding ecosystem of services that are seamlessly integrated around the core platform.

The initial integration involves the costs of incorporating these analytics capabilities into the platform. Operational costs cover maintaining the analytics infrastructure and ensuring data accuracy. Over time, this customer-centric approach contributes to improved customer satisfaction and loyalty, impacting the TCO positively.

The introduction of automatic renewals and real-time claims coverage verification within the SimpleINSPIRE ecosystem underscores a commitment to improving client satisfaction for our clients. The ripple effect of such client-centric automation is far-reaching with the SimpleINSPIRE platform contributing to a 25% boost in customer satisfaction. This elevated satisfaction translates into a substantial 12% increase in customer retention rates. Here is a deeper insight into the 10 ways insurers win with SimpleINSPIRE’s core insurance platform.

Data-Driven Strategies are Redefining Growth and ROI

The effectiveness of insurance platforms in leveraging data analytics and machine learning capabilities directly shapes their growth trajectory. In P&C insurance, where risks are diverse and market conditions rapidly change, the ability to harness sophisticated data analytics becomes a strategic imperative.

Commercial insurance companies employ diverse actuarial models to price policies for their customers. These models consider factors such as industry, location (especially for property insurance), and weather conditions (e.g., higher premiums in hurricane-prone areas like Florida). Traditionally static, these actuarial models have been transitioning toward automation and increased integration of Machine Learning (ML) for underwriting and claims forecasting even before the COVID-19 pandemic.

State Farm uses data analytics extensively to segment its customer base. By analyzing diverse data sets, including demographics and behavior, the insurer tailors insurance coverage to specific customer segments.

Allstate utilizes advanced analytics for real-time claims fraud detection. By analyzing claim patterns and external data sources, Allstate identifies anomalies indicative of potential fraud. This data-driven fraud detection not only minimizes financial losses but also reinforces trust among policyholders and maintains fair premium pricing.

Operational Efficiency and Workflow Automation as Insurance TCO Drivers

Legacy systems are characterized by manual and time-consuming processes, leading to higher operational costs. Contrast this with a modern insurance platform incorporating robotic process automation (RPA) and Machine Learning Models. While the initial investment in implementation may seem significant, the long-term impact on TCO is substantial.

Equipping agents with cutting-edge tools significantly improves their efficiency and leads to quantifiable time savings. If we consider 250 agents saving 30 minutes daily, the company gains a substantial 28,750 hours annually, resulting in cost savings of around $1.125 million.

SimpleINSPIRE core platform is a prime example of a substantial reduction in time spent on manual tasks through its automation capabilities. This is because the platform provides insurers with either fully automated policy processing or a hybrid of automation and manual processing based on the Line of Business (LOB). The time-saving is not just an efficiency gain; it represents a liberation of valuable resources, allowing insurance professionals to focus on high-impact aspects of their roles.

In closing, SimpleSolve handles the operational heavy lifting, leaving you free to focus on your core business. Our PEAR Methodology (Partnership, Expertise, Accountability, Results) of software delivery empowers insurers to drive growth, innovation, and value creation. Moreover, the SimpleINSPIRE platform's seamless integration with ecosystem partners offers over 70+ game-changing insurtech products, making your journey to streamlined operations and strategic growth not just simplified but enhanced. Would you like a demo today?