Is The Technology You Use Improving Your Credit Rating?

Innovation is almost always considered in a positive light. What could be more revolutionary than anytime money? The advent of cash dispensers, now known as ATMs, made it possible for people to access cash even out of banking hours, and at the time, the convenience of it was astounding. Banks themselves reaped dividends through a lowering of costs. As communication networks improved coupled with faster payment processes, the insurance industry too hopped on to the innovation boom. One that made a big impression was the drastic reduction of processing time for insurance claims, as it moved online.

Innovation is coming at us fast, in every aspect of our lives.

The U.S. Credit Rating Agencies and Insurer innovation

Crediting rating agencies sat up and took a long, hard look at the impact of innovation on the long-term financial success of insurance companies. AM Best, the world’s first and also the largest credit rating agency, had indirectly included innovation through the various building blocks of its rating process. This changed in 2019 and became more center-stage when the agency sent out a draft report “Scoring and Assessing Innovation” that recognized the impact of disruptive and data technology for insurers and the fallout if insurance companies failed to invest in innovation. A year later, the venerable agency revised Best’s Credit Rating Methodology (BCRM) and it became effective immediately. Other independent rating agencies such as Demotech are likely to follow suit.

AM Best defines innovation as a multistage process whereby an organization transforms ideas into new or significantly improved products, processes, services, or business models that have a measurable positive impact over time and enable the organization to remain relevant and successful. These products, processes, services or business models can be created organically or adopted from external sources.

The blistering rate of technological development has got AM Best to include a score for innovation within the business profile component when giving an overall rating for carriers, while the others have not yet decided on a separate score for innovation. Agencies like Fitch say “innovation already bleeds into every component of our analysis”. The one common ground that all credit rating agencies agree on is the importance of innovation to the overall financial health of an insurance carrier.

Also Read: Is Your Tech Stack Holding You Back from a Full Digital Transformation?

AM Best’s criteria for scoring innovation

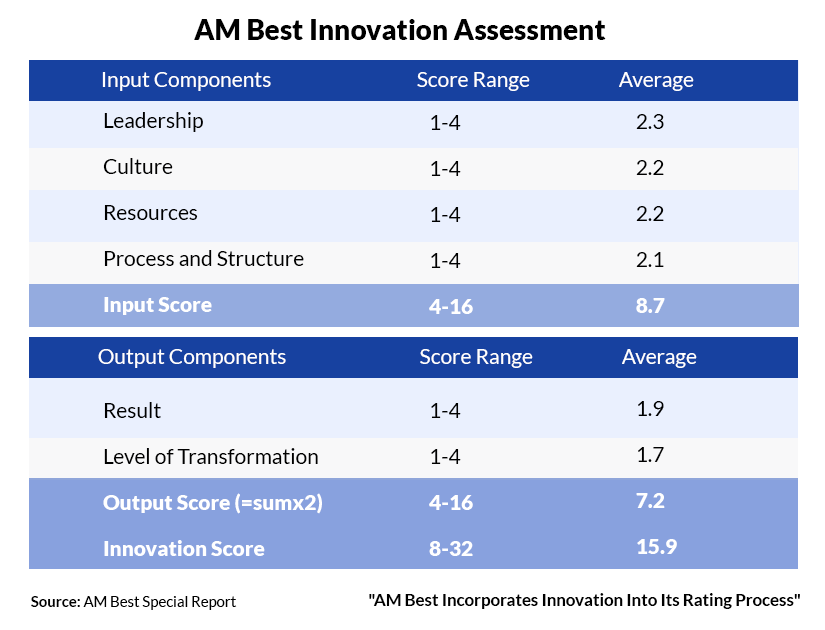

- Evaluation of a company’s innovation level for the U.S. is based on two main components — an input score and an output score.

Innovation score = Innovation input score + innovation output score

- The input score has four subcomponents— assessments of (1) Leadership (2) Culture (3) Resources including allocation, strategy, and management (4) Process and structure. Each of these subcomponents is scored between 1 to 4 (higher is better) with a maximum input score of 16.

- The output score has two components — one measuring results and the other, the level of transformation—with each also graded on a 1-4 scale. The output score is given a double weightage with the highest score of 16. An example of a measurable output score is if the organization shows a decline in expense that is directly linked to a specific innovative process.

Innovation Output Score = 2 x (results + level of transformation)

Ultimately, innovation has to show results, and investment in resources must be worthwhile. On the other hand, innovative processes take time to show measurable outcomes. This is why AM Best uses the previous 5 years as the timeframe for scoring output and also allows for failure because every innovation is not always a sure shot. The credit rating agency also looks at how companies gain knowledge from innovation failure.

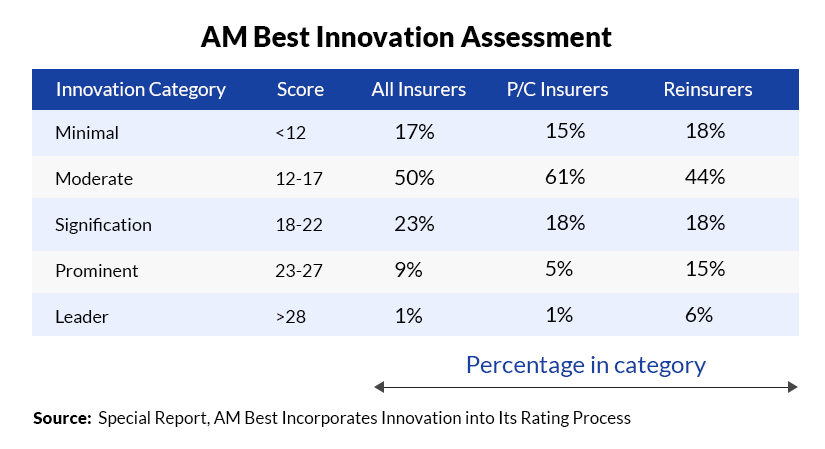

The draft report had some important insights – 50% of all insurers and 61% of P/C insurers fall in the moderate category, Reinsurers though had 21% in the two highest categories i.e. prominent and leader with a score of 23% or more.

So, why are there more innovative leaders in the U.S. among reinsurers as well as health and auto insurers? The 3 reasons it narrowed down to are their simplicity of underwriting and claims demands. Many of them are start-ups and hence have fewer legacy problems and allow for a more innovative culture. They have also entered into partnerships with InsurTech intermediaries to attract more business quickly.

Also Read: 7 Signs of a Legacy System - Sign 6 Might Surprise You

How technology is reshaping insurance operations

Digital-first companies have been able to shrink their expense ratios by almost 40% of the traditional carriers. Technologies such as automation, big-data analytics, and digital applications are transforming operations. The increased advances in AI have provided the impetus to automate complicated tasks and not the least of these is answering customer queries. The flexibility provided by these applications are also allowing customers to serve themselves during the underwriting, servicing, and claims processes

Insurers who have more mature technology are adopting a suite of Internet of Things (IoT) technologies. One of the innovative ways this technology is used is in home insurance. IoT building sensors are sending a stream of data in case of risk and damage and this is replacing in-house visits by claim adjusters. By extending the capabilities of IoT, insurers will be able to provide dynamic risk assessment at work sites or businesses and even reduce insurance losses on roadways.

Whether or not insurance is scored as a separate metric is not important. The message going out to all carriers is that status quo operations are detrimental to their financial performance. This is an era of continuous innovation. Large insurers will use their capital clout to invest in emergent technologies. Smaller insurers will have to balance these expenditures against other priorities. But the writing is on the wall, improve products and services and the customer value proposition or you might be left behind.

Is your technology platform helping you innovate?

Topics: Digital Transformation

.jpg)