Making It Connect: Pairing Core Function Solutions From Multiple Vendors

The insurance landscape is changing quicker than ever before. Technology disruptions and intense competition in the sector are making insurers consider new IT vendor management strategies. Integrated solutions that have the flexibility to seamlessly link to third-party solutions are considered the most advantageous in a competitive market.

Why some companies may consider multi-vendor systems

There are many single vendor advantages for IT infrastructure management, not the least being a single vendor takes full responsibility. and you have a complete solution on one platform, with no compatibility problems. And it comes at a lower price. However, there are many reasons that insurance carriers might consider a multi-vendor system

-

When migrating from a legacy system, businesses prefer to do it one module at a time. This prevents any downtime. However, a great many legacy systems do not use a software architecture that allows integration of disparate systems using differing protocols.

-

An integrated solution might have all the core functions you need, yet there are instances where there might be a new functionality you would like to add on, from a different vendor. Modern integrated solutions like SimpleINSPIRE provide for easy integration with APIs of other providers.

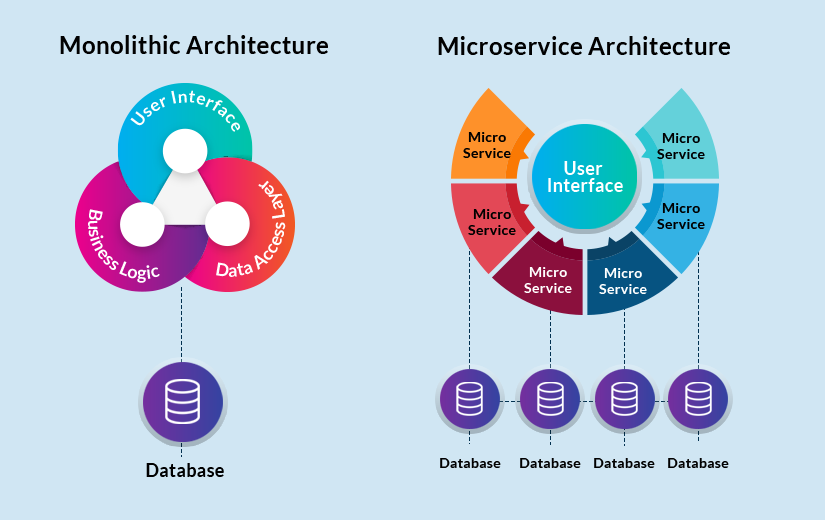

Some insurance carriers opt for a microservices infrastructure that is decentralized. This system will enable independent components to be integrated and evolve independently. Unlike a single-service approach where different components are intertwined, in a microservices structure, each service can act as a separate entity.

This is the biggest advantage of microservices when compared to monolithic architecture. In the latter, when there is a failure in code, it can have a cascading effect on more than one function because of its tight integration. In a microservice, the effect is minimal. In fact, when several services are brought down for maintenance, users will not even be aware of it. At the same time, loose coupling ensures that integrations are effective enough to enable smooth communication and seamless functioning as a whole.

Understanding Monolithic Vs Microservices Architecture

|

A microservices infrastructure, be it an integrated platform with same-vendor or multiple vendors providing technologies for different processes, can foster an environment for agile, efficient development. Since network architects segregate the whole system into smaller, independent functionalities, insurers can then choose providers of their own liking for each component depending on their requirements.

For instance, say you believe that an existing insurance solution provider is the best vendor for cloud computing, policy management as well as claims management. However, you want a different provider for billing and accounting. The flexibility that comes with a microservices design can help with this since integration of different components and applications will be hassle-free.

Some of the key advantages of multiple vendor services in insurance are

-

Flexible solutions for different processes will help you find the best fit for your needs.

-

It will avoid vendor lock-in because if one process does not meet your expectations, you can always switch to a different vendor without disrupting other processes.

-

A multi-vendor services approach is also a great way to manage risk. If one of the vendors goes bust, it does not put your entire business on the rocks.

-

It will also make it easier to manage demand fluctuations among different on-demand products since IT infrastructure management is flexible.

-

Since every process has its own vendor, updates and upgrades will be on time. With the right integration, this can help improve your overall competitiveness in the market.

With that being said, a solid multi-vendor IT infrastructure management strategy will need a good integration platform that supports these different functionalities. A good platform needs to be backed with the right technology that allows distinct services to collaborate effectively and function in a manner that does not compromise the efficiency of any process.

How to ensure the success of a multi-vendor service strategy

Integrating IT solutions from multiple vendors has its advantages for sure. Yet, success depends on the right implementation strategies. To ensure that your multi-vendor service strategy works, here are some things to look out for:- Make sure that your underlying APIs support multiple vendor integrations with ease. Without this, no matter the strength of vendor solutions, your system will still crash.

- Have a good understanding of how different vendor systems function and be willing to adapt your work practices to fit varying needs.

- Improve cross-vendor cooperation and support partnerships for a smoother flow. When your vendors have a good rapport, it will become easier to troubleshoot when things go awry.

- Monitor different processes and functionalities to identify which ones are working for you and which ones are not.

The SimpleINSPIRE Solution

SimpleINSPIRE is an integrated, multi-line insurance platform that is designed to help you grow your insurance business in the current competitive market. Our user interface is based on Angular Framework, which creates user-friendly interfaces. Simultaneously, our application microservices will give your insurance business the flexibility to add more features and pages to the system as and when you require it.

For instance, our Adjustermate mobile app is designed to import assessments and photos not only into the SimpleINSPIRE claims system, but can be independently integrated into any other claims system with the right APIs. This fluidity across all solutions makes SimpleINSPIRE a proven enterprise-level solution for all, from start-ups to $10bn insurers.

We have both the software as well as the people to ensure that your insurance organization can integrate fast, high-performance products.Talk to us, today.

Topics: Digital Ecosystems

.jpg)