Driving Growth: Speed-to-Market Strategies in a Competitive Market

Some things in life are just better small, like waistlines and debt. But when it comes to profit margins – you never want them to shrink. In 2023, the life insurance and annuity sector had a more stable year than Property & Casualty insurance. The escalating loss ratios have made it imperative for P&C insurers to innovate quickly. For instance, on January 1, 2024, reinsurance rates for U.S. property catastrophes surged by up to 50%, impacting policies previously affected by natural disasters. (reported by Reuters).

With the current economic challenges, customers are seeking affordable insurance solutions more than ever. Speed to market is key to staying ahead in this competitive environment. To be able to swiftly bring new and updated insurance products from idea to consumer isn't just smart—it's essential for capitalizing on emerging opportunities.

The Need for Speed for Insurance Products

Staying ahead of competitors is about making the right moves at the right moment. Insurers are pressured to meet the growing demand for affordable insurance options while fending off competition from disruptive players.

Speed to market in insurance refers to the ability to swiftly bring new products and services to customers. For example, specialty insurance is like a high-speed race car maneuvering through a constantly changing track filled with twists, turns, and unexpected obstacles. These policies cover risks that are always in flux— Imagine dealing with tens of thousands of risk locations, complex processing, and multiple rating requirements—all while racing against time.

The quicker that insurers can analyze and rate risks, the better they can react quickly to market trends, and adjust coverage terms on the fly. It's like having turbo boosters on their insurance platforms.

Also Read: Community Insurance Companies vs. Industry Giants - Strategies to Win

Navigating Challenges in Speed to Market

Despite the imperative for speed, it is easier said than done. Insurers encounter several obstacles along the way. These include complex decision-making processes, skills shortages, legacy IT systems, and stringent compliance requirements. Additionally, the need for thorough testing and refinement further complicates the path to market.

Deloitte's study reveals that insurers typically spend 12 to 18 months creating a new product and 3 to 6 months modifying existing coverage. By the time the insurance product is ready, it may no longer meet customers’ current needs - the market is too dynamic for such lengthy risk management strategies.

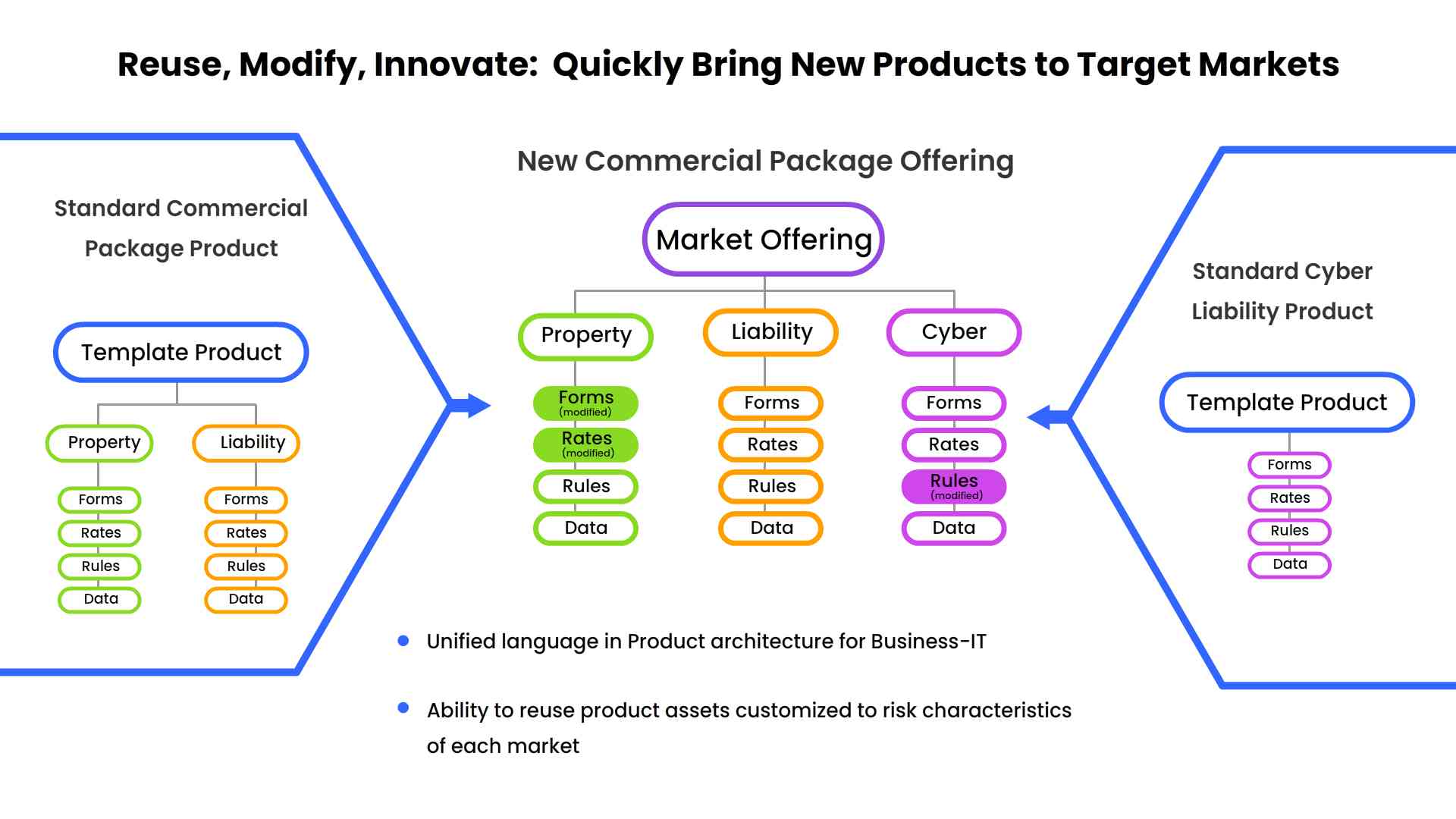

If insurers have to innovate by creating new, market-relevant insurance products at the speed of business they have to look at dealing with the stumbling blocks. One of the ways is reusing common product definitions across portfolios, enabling tailored coverages without the need for a large and costly product library.

Insurtech competitors, unencumbered by legacy systems, are deploying innovative products backed by automation, AI, and straight-through processing and are reaching their customers directly through various digital channels.

Strategies for Acceleration viz a viz Speed to Market

Strategies for Acceleration viz a viz Speed to Market

To overcome these challenges, insurers must rethink their approach to product development. This involves rewriting business logic to streamline collaboration among various stakeholders, embracing new technologies, and prioritizing flexibility and efficiency in processes.

By 2025, the insurance industry could automate up to 25% of its vital operational processes. This automation is poised to streamline operations and significantly boost speed to market. - McKinsey

1. Simplify! Simplify!

Gone are the days when insurers could introduce a product and let it run unchanged for a decade. Nowadays, insurance product lifespans are much shorter, with insurers often needing to retire products after just months of launch due to irrelevance or inadequacy.

Given this dynamic landscape, carriers must simplify their product offerings and ensure they're easily understandable. Historically, the industry has tended to layer on numerous riders, resulting in overly complex products. Today, insurers must adopt a more open and flexible approach to feature bundling. Simplification doesn't have to be complicated; it involves standardizing product features and processes wherever feasible, while only introducing differentiation where it provides a clear market advantage.

2. Overcoming Inconsistent Product Management

A major hurdle impeding speed to market is the absence of a unified, systematic approach to product management. The lack of cohesion and collaboration among operational units and geographic locations often results in a proliferation of insurance products. This redundancy increases maintenance costs and creates inefficiencies for both business and IT departments. After all, business models to be viable must reduce the operating cost per policy and claim.

To surmount this challenge, it's necessary to establish a well-defined process workflow for new products. This structured framework enables effective management of each stakeholder's involvement in the product innovation process as required. Moreover, democratizing access to intuitive technology tools ensures that business users, not solely IT teams, can actively contribute to the innovation process.

3. Technology is the Back Bone for Bringing Products to Market Quickly

In this pursuit of speed, technology plays a crucial role. Solutions like document creation, automation, and distribution tools can streamline processes and integrate seamlessly with existing systems, enabling insurers to bring products to market faster and more efficiently.

If insurers need to embrace speed as one of their core principles, it can only be done through strategic technology partnerships, which offer more than just speed. These partnerships can streamline underwriting processes while also enhancing accuracy and providing valuable insights.

Insurance, carriers and MGAs excel at creating, pricing, and delivering products tailored to meet market demands. However, the software platforms necessary to facilitate these core competencies often lie outside their expertise. Today, low-code and no-code SaaS platforms have emerged as powerful tools..

One significant area where low-code/no-code solutions shine is in the creation and implementation of pricing models. Traditionally, this process involved a tedious cycle of actuaries creating pricing models in Excel, which then needed to be translated into code by IT personnel before reaching the underwriting team. This back-and-forth communication often led to delays and inefficiencies. However, with low-code/no-code solutions, this process is streamlined, eliminating the need for extensive involvement from IT personnel.

More of Interest: Why Not Every Insurance Platform Delivers on its ROI Promise

4. Efficient Product Rollout Across Business Lines and Regions

State-specific requirements often lead to delays and inconsistencies in product offerings. By leveraging technology, insurers can address these issues and expand markets beyond state limits. For example, an insurer looking to offer two distinct products across all U.S. states and Canadian provinces can quickly achieve this by adapting a Commercial Combined base product. This product encompasses a comprehensive insurance offering for businesses, including a Commercial Package Policy module that covers property and liability risks, as well as a separate D&O module specifically addressing directors' and officers' liability. With minor adjustments to attributes like rates, rules, taxes, and forms, each module can be packaged separately or as a combined product for each country or state, efficiently meeting business needs.

5. Being Second Out of The Gate May Carry Less Risk

While innovation is certainly on the rise, not everyone needs to lead the charge. Sure, being a trailblazer has its allure, but it also carries significant risks. There's something to be said for those who can swiftly bring similar products to market by leveraging a flexible platform. After all, diving headfirst into uncharted territory can be daunting. That's where the concept of being a close second comes into play.

By following closely behind the pioneers, organizations can reap the rewards without bearing the brunt of the risk. After all, if someone else has already paved the way, why not capitalize on their efforts and get similar products out there quickly?

For insurers looking to enhance speed to market, a critical first step is to assess their current processes and identify areas for improvement. Successful companies prioritize collaboration, empower business users with accessible technology, and cultivate partnerships with solution providers. They also embrace a culture of experimentation and iteration, allowing them to quickly adapt and refine their offerings.

For further insights on the SimpleINSPIRE platform's innovative strategies to develop, deploy, and scale your P&C insurance products, reach out to us today or call us at 609-452-2323 for a demo.

Topics: Digital Transformation

.jpg)