What’s Keeping Insurers from Using Insurtech More Effectively?

Innovation can come in many forms and is almost always accompanied by breakthrough technologies. Insurance leaders are looking for innovation in digitization and upgrading legacy operations as well as improving the experience of policyholders. But change needs more than this, it needs innovative approaches that require thinking and acting differently from the norm.

The Deloitte Center for Financial Services, has put it most succinctly in their 2019 report - To innovate, insurers must evolve not just transform.

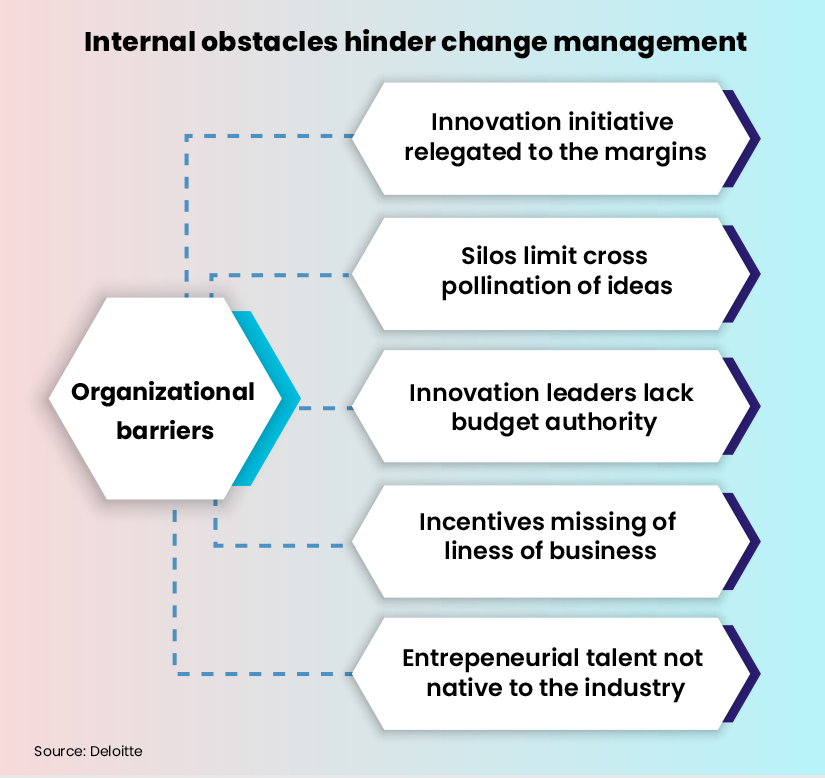

So, what is keeping Insurers in the United States from evolving? Insurance carriers have been spending a lot more money and time in upgrading their existing systems and this is important to improve their rating. However, they do not have dedicated teams to work on new operating models that can differentiate their services from others going into the future. And the troubling part is that the future is here.

Insurance carriers recognize the lacuna. Most say that 90% of resources go to improving current processes while only 10% goes towards innovation. This gap must close.

Innovations spurred on by Insurtech

'Insurtech' is an umbrella term used to describe new technologies that are bringing in an exponential disruption to the business models and regulatory practices in the insurance market. Advanced technologies like AI and Cognitive Computing as well as Robotic Process Automation (RPA) together promise business agility. Often these innovations are coming from collaborative technology partners. The burden is therefore not always on insurance carriers to be “trailblazers” but they should be open to using emerging solutions to be offensive rather than defensive.

To cite an example, Root Insurance is an American startup that is the country’s first licensed insurance carrier to offer auto insurance entirely through an app. Good drivers get much lower insurance policy quotes as long as they allow the company to track their driving habits for a while.

Another insurtech company, Hippo Insurance, offers homeowners an insurance quote within 60 seconds through their website. That places a benchmark that insurance agents from traditional carriers just cannot match.

The global insurtech market is growing rapidly and is expected to reach $1019.1 million by 2023. So, what’s holding back traditional insurance carriers from using insurtech?

Also Read: Best-of-breed vs Integrated Systems: Which is Right For Your Company?

The barrier to insurance product innovation

The Economist claimed, “The future of insurance is happening without insurance firms.” Digitization in the insurance industry is definitely in full swing and insurers are well aware of that. Yet, for traditional insurers, embracing insurtech comes with many challenges.

-

Habitual silos

Insurers in America as elsewhere, are generally used to functioning in silos. Large insurers tend to segregate business lines on the basis of risk and product offerings. Even within individual business verticals, communication among specialized departments for actuarial, underwriting, operations, IT, claims, etc. is limited.

Innovation requires a company-wide approach, especially when it comes to digital innovation. A 2019 McKinsey study pointed out that a vast majority of insurance carriers are still struggling to integrate online and offline distribution channels. When customers cannot toggle between both seamlessly that becomes a brick wall to user experience . This traditional siloed structure has held back many insurance carriers from effectively rolling out innovative insurance products.

-

Regulatory impediments

Another challenge is the regulatory obstacles. For one, capital regulations that were previously applicable to banks have been extended to insurers. Higher global standards for compliance and licensing also make traditional insurers wary about adopting newer products. The Insurance Data Security Model Law adopted in at least 11 states in the U.S. has strict cybersecurity norms for regulated insurance entities.

Rating agencies are putting pressure on insurance carriers to drive up innovation. For instance, A.M. Best is systematically assessing factors contributing to innovation as well as measuring outcomes across a 5 point scale. Their mandate strongly states that innovation is a leading indicator of market position and in turn financial strength.

-

Lack of knowledgeable inside leaders

The world might have a surfeit of emerging technology but without tech leaders within the system to spearhead innovation, change is likely to be slow. This is a common issue among large, traditional insurance carriers. While insurance leaders are adept at identifying risk and accurate claims processing, not many have been at the forefront of innovation. Carriers should consider bringing out-of-the-box thinkers from outside their industry. This might be a tectonic shift for many large carriers.

A middle ground that might have more buy-in, would be to partner with insurtech companies rather than just buy products from them. Insurtech companies have the technological expertise, entrepreneurial skills as well as innovation built into their DNA.

-

Cost and resistance

While many insurers are aware that their existing models are holding them back from a complete digital transformation, investing in insurtech is costly. From data migration to implementing analytics and AI models to existing workflows is not a one-time investment. Moreover the human element can be ignored only at the company’s peril. Resistance from existing staff to switch to a digitized process flow can lead to a failure in billion

A McKinsey study on digital transformation showed that 70% of digitization initiatives in all industries fail because of resistance from employees.

The future of Insurtech and being part of the change

The insurance industry does not have a clear cut approach to insurtech disruption yet. Now is the time for insurers to really consider the impact of technology. Changing customer habits and preferences means that insurers can no longer continue to be slow with tech adoption.

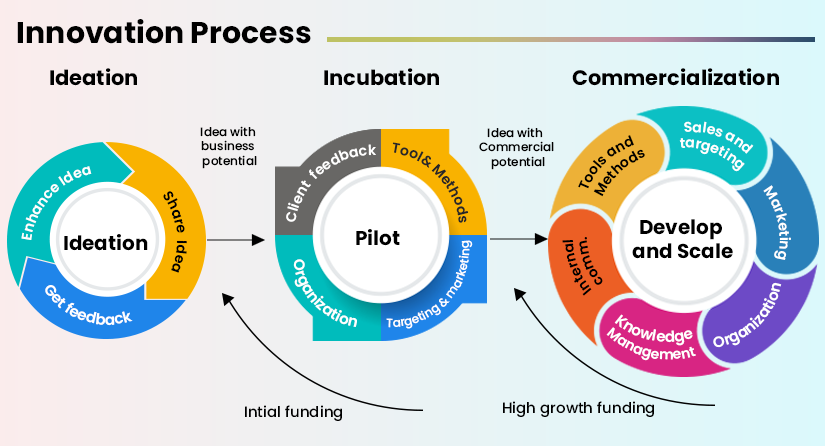

To be fair, reinventing an insurance carrier’s operations overnight is a daunting prospect. Instead, innovation in the insurance industry needs to be looked at through a new lens. Insurtech startups can be facilitators that help traditional insurers navigate the changing landscape.

There are plenty of insurtech startups that already exist in the market. Instead of viewing independent insurtech companies as direct threats or disruptors, the logical way ahead is for traditional insurers to join forces with the incumbents.

An example is worth a thousand words, so here is the proof: U.K.-based Aviva partnered with an insurtech startup to provide small-medium enterprises with case-specific, monthly insurance subscriptions.

In Switzerland, Zurich Insurance Group took a similar approach to partner with an insurtech startup to provide online insurance policies to small businesses.

While many insurers are already looking to insurtechs as vendors, collaborations are a more sustainable solution. Insurers who can partner with multiple insurtechs to solve important challenges like claims management, risk analysis using new technologies or agent empowerment will be on the path to becoming true insurance innovators.

Topics: Digital Transformation

.jpg)