Why P&C Insurance needs Natural Language Processing

A customer comes to your website and opens up the chat window. Within seconds, a chat assistant collects their information, offers them tailor-made recommendations, and guides them if they have questions.

In most organizations, it would be almost impossible to provide this level of instantaneous support through human agents, as the volume of customer queries is too high. However, response times are one of the most important determinants of customer satisfaction. This is where Natural Language Processing for insurance (NLP) comes in.

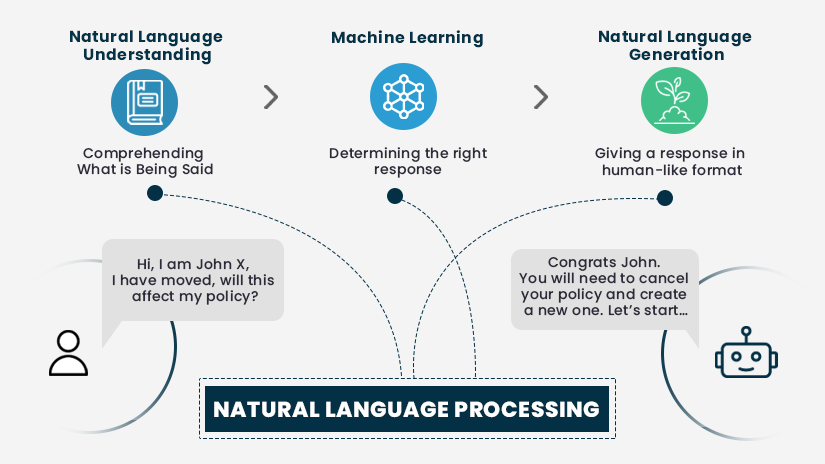

NLP is a form of artificial technology in which large amounts of data are processed to analyze and mimic the way humans communicate. While conversational AI-powered chatbots are one of the most popular NLP applications, the technology actually has several other potential uses within insurance. But first, let’s take a step back and understand how NLP technology actually works.

NLP vs AI technologies

Artificial Intelligence is the umbrella term for technology that mimics human behavior. It involves learning repetitive, predictable tasks and replicating it on a larger scale and within a faster time than humans could ever perform them. Natural Language Processing is one of the subsets of AI technologies and is concerned specifically with human speech, or linguistics. NLP applications can understand unstructured data (human language) and interpret it in meaningful ways. This is important because it can help bridge the gap between human and machine language.

Previously, coding language was the only way to input information, now machines can understand us in the natural way we communicate, understand the intent behind language, and ultimately, automate communications. This lends NLP technology to a huge array of uses, from extraction of insights from large volumes of data to the conversion of spoken language to text and vice versa.

Read also: AI for Insurance - Everything You Need to Know

Advantages of Natural Language Processing in Insurance

The global NLP applications market is forecasted to be valued at $48.46 billion by the year 2026. It was valued at USD 10.72 billion in 2020. This is a 4x growth and the expectation is that more industries, particularly insurance, will find more use cases for the technology. Insurance carriers can leverage this technology to deliver better CX and increased operational efficiency.

-

Speed and personalization in customer delivery

Personalization and speed are the two biggest determinants of customer experience. Customers do not want to wait indefinitely on hold, only to be put in touch with a representative that does not know their history or policy details. Customers want to be recognized, valued, and have near-instant resolutions.

The challenge: For insurance companies, it can be difficult to meet customer expectations because human-only support teams are difficult to scale up or scale down. This is where chatbots come in. NLP AI chatbots, however, are different from standard bots that use preset ‘Canned Responses’ to automate communications. Canned Responses have a rigid set of rules and the bot will have to route the query to an agent if the customer’s question goes beyond its scope.

The solution: AI-powered chatbots, on the other hand, are a lot more sophisticated. They are capable of understanding the user’s intent and providing them with suitable options through a text-based or voice-based response. For example, an NLP-based auto insurance chatbot can recommend a suitable policy coverage and price to a customer based on their profile. Even if the query does eventually get routed to a human agent, NLP can provide the agent with all the background information about the customer to save the agent time.

Better customer service extends far beyond just customer satisfaction. It has a real business impact. Customers who have a positive experience are far less likely to churn and are more likely to be open to cross-sell and upsell opportunities.

Also Read: Technology is at its best when it is invisible

-

Improve fraud detection capabilities

Fraud is expensive for insurance companies. The legal issues and the excessive payouts for fraudulent claims can add up and result in a huge cumulative loss for insurance carriers. In fact, one report by the FBI states that, excluding health insurance, insurance fraud could account for $40 billion in losses annually.

The Challenge: Given the huge volumes of claims being processed, it can be close to impossible for carriers to identify every single instance of fraud. NLP technology, however, can analyze information in a fraction of the time it takes humans.

One of the solutions: Despite most claims-related information being in the form of unstructured data (such as email, call notes, or text messages), NLP can understand and categorize it. It can detect recurring patterns in past fraudulent claims and raise an alert if a new claim follows the same pattern.

-

Achieve faster claims processing times

The Challenge: A significant portion of insurance agents’ time goes into processing claims. Despite improvements in technology, many parts of claims management are still manual. This makes it difficult to ensure a zero percent margin of error.

A solution: Using the voice-to-text functionality of NLP, insurance carriers can potentially use a virtual assistant to gather customer details over the call and fill in the fields of a claims form with that information. Depending on the sophistication of the application, NLP AI tools can also potentially cross-verify the claims form with the individual’s policy details, assess it for fraud and approve or reject the claim without a human agent having to intervene, till the final step. This entire process takes place almost simultaneously and in a much faster time than it would take a human agent to perform the same task. This frees up a lot of time for insurance agents, who can then prioritize more time for complex tasks that need their expertise.

-

Ensure greater accuracy in underwriting

In the insurance industry, underwriting is an art form. Underwriters need to account for a huge amount of variables, accurately determine risk and ultimately decide an applicant’s eligibility for a specific insurance policy or pricing. Precisely because there are so many factors to account for, it can be challenging for underwriters to make an accurate estimation every time.

The solution: At SimpleSolve, we consider ‘Every claim is a failure of underwriting’. Tara, NLP technology is emerging as one of the most promising developments for precise underwriting. The technology can automatically analyze volumes of unstructured past data and reach data-backed conclusions. In P&C insurance, for instance, NLP can correlate details of the property with external variables such as past weather patterns, instances of natural disasters in the area, likelihood of catastrophic events to occur again, etc. The tool can then reach an accurate estimation of risk and modify policy coverage accordingly.

Natural Language Processing insurance technology is one of the most exciting avenues for innovation in insurance. By investing in NLP, insurance carriers can empower their agents to focus on what they do best: contribute to strategic business initiatives and build empathetic relationships with customers.

Topics: Intelligent Automation