Why ‘Not So Good’ Risks Often Go to Smaller Insurance Companies?

Any economic textbook will draw a correlation between the size of a company and the reduction in average operational costs. However, what this core belief rarely emphasizes is that profitability is also directly proportional to an operational model that uses technology, data, analytical solutions and digital distribution models that reduce customer acquisition costs by reducing operational costs for every quote.

In this scenario, can mid-size and small insurance companies turn things around?

The ‘Law of Large Numbers’ when applied to smaller insurance companies

The law of large numbers originates from a probability rule in statistics that the average result when the sample size is large more closely reflects the expected value.

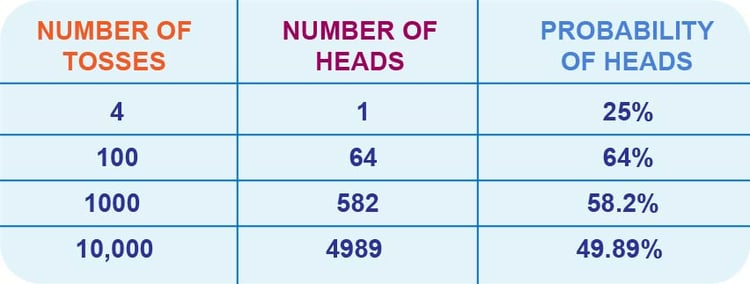

The law of large numbers can be explained using a simple coin flip where the person gets half a point or 0.50 if it falls head. The law of probability says the chances of it landing heads rather than tails is 50% so the average expected value is 0.50. However, if you flip the coin only twice then the actual value might not meet the expected value i.e. if it lands with heads both times then the value would be 1, or if it is tails both times the value could be 0. However, if you increase the number of observations, the average would work out to a number closer to the expected value of 0.50. That is the theoretical side of the law of large numbers and insurance uses it frequently.

When specifically applied to insurance, the law of large numbers states that as the number of policyholders in a class increases, the more confident the insurance company is that the possible claims payout will not exceed the expected value. Insurance companies use the law of numbers to average the probability of claims value they might be likely to pay out. When it works perfectly then it makes the company more stable.

The larger the pool of policyholders the greater the prediction accuracy of loss exposure

Practically, it equates to more easily establishing the correct premium and reducing the insurance company's risk exposure. In other words, if the insurance company can issue 5000 rather than 500 fire insurance premiums it can stabilize its loss exposure. By acquiring a large number of similar policyholders, they will all contribute to the fund from which the loss will be debited. Policies can be priced accordingly.

However, if the rule of numbers were to completely hold true then there would be only a few giant insurance companies rather than the 5965 insurance carriers in the United States as of 2019 NAIC data. In the real world, there are other factors at play that are not considered in the law of numbers - including operational efficiency, calculating effective premiums, and the ability to mitigate loss after a claim is filed.

Large vs Smaller Insurance Companies and effect on PIF

The terms ‘small’ and large’ when it comes to insurance companies are not defined. The general understanding is that the smaller insurance carriers are usually the local offices that are established within a community or state. Regional insurance players know local conditions better and have customers who prefer to do business in person. For example, in auto premiums, the likelihood of hitting a deer is higher in Montana vs California. Neither do you need to insure for hurricanes in New York, while it is an annual concern in Florida?

Large carriers are those that write policies on a national level and their advertising budgets reflect this. The large players are usually supported by large call centers that can be reached 24/7 and may have a limited number of local offices. Geico fits this profile of a large insurance company with local offices and is often considered a competitor for regional companies.

The count of PIF or policies in force determines the specific insurance carrier’s reach in a certain geographical region. However, the PIF count on its own is not what worries small and midsize insurance carriers. Rather it is how many premiums they have with quality risks.

Large insurance companies use the 80:20 Pareto Principle i.e. that 80% of your sales come from 20% of your customers. In other words, the probability is that for every 100 potential customers to whom a quote is sent, 20 of them will convert. But insurance carriers do not leave this to chance. They employ insurtech good use tools to evaluate for quality risks. These tools are usually subscription-based and using this for every potential customer could mean that costs can go up.

Smaller or regional insurance players might be hesitant to use ‘know your customer’ insurtech solutions at the same frequency as deployed by national companies because of the higher investment. The downside of this is that the not-so-good risks go to the smaller companies and they often have larger claim payouts.

The probable way out of this is to selectively pick customers for evaluation through good use of insurtech tools.

Also Read: The Problems Insurers Face if They Ignore Digital Ecosystems

Integrated KYC insurance tools

Online shopping for insurance is often taking away the advantage that regional insurance companies traditionally enjoy. An increased percentage of consumers aged below 44 years are purchasing online. The fallout of this anonymized insurance purchase journey is that insurance agents barely interact with their new customers even during onboarding - how are they to know who they are let alone what is happening in their lives where insurance can be upsold? It is the present reality for small and mid-size insurance carriers who have relied on knowing their community.

According to a Deloitte report, 48% of financial institutions say that outdated AML compliance tech is their biggest challenge. New insurtech solutions have addressed this problem to an extent.

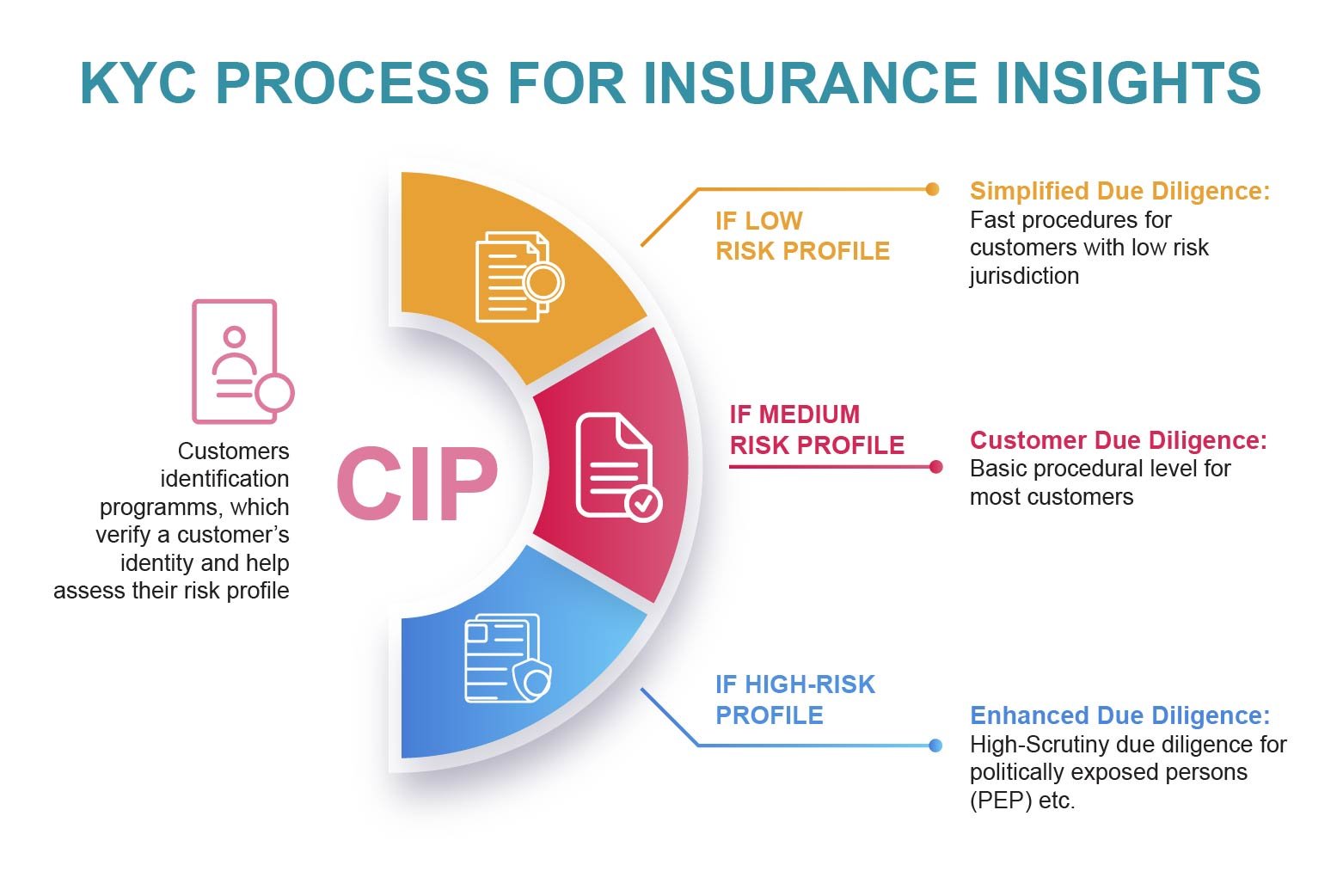

Know Your Customer (KYC) /Customer Due Diligence (CDD) acquires contextual information, either in structured or unstructured form. While KYC insurance insights are all about data to verify identity proof, CDD goes a step further by performing background checks and assessing risks by looking at various factors to rule out any anomalies. This could include assessing financial transactions to mitigate financial crimes. Advanced technology makes it easier to curate risk profiles on individuals as well as entities. For instance, Moody has over 6+ trillion names screened and monitored.

Often KYC/CDD solutions can be offered as part of the Anti-Money Laundering Solutions suite. While advanced KYC solutions are available, costs can add up in customer acquisition.

The insurance industry beats out most other industries in the cost of customer acquisition which is an average cost of $900

Regional insurance carriers could leverage strategic partnerships

Regional incumbents will have to reduce their cost profiles to stay competitive. There is no getting away from it that creating a bionic operations model along with deploying new technology has to be on the table for discussion.

Insurance companies might be more concerned with safeguarding their existing market and might rely on adaptation initiatives rather than innovation. However, while this might gain them short-term benefits like improved customer satisfaction, it ignores long-term survival risks. The latter requires companies to leverage more innovative technology balanced with their strategic goals.

Marketing powered with customer insight data is now a must-have compared to a few years back. It is 5 times the cost to attract a new customer compared to retaining an existing one. Most regional players cannot compete with the large insurance companies that throw out a wide net in their advertising strategies. Smaller insurance companies must do away with outdated customer acquisition methods. Spending big does not necessarily win the acquisition game. Rather, a more tailored, personalized method that targets customers with the greatest ROI potential works better in the present digital age.

Partnerships with insurtech have become a necessity for small insurance companies to take part in digital ecosystems that can provide in-built access to AI tools.

Topics: Risk Management

.jpg)