5 Examples of IoT in the Insurance Industry Powering America

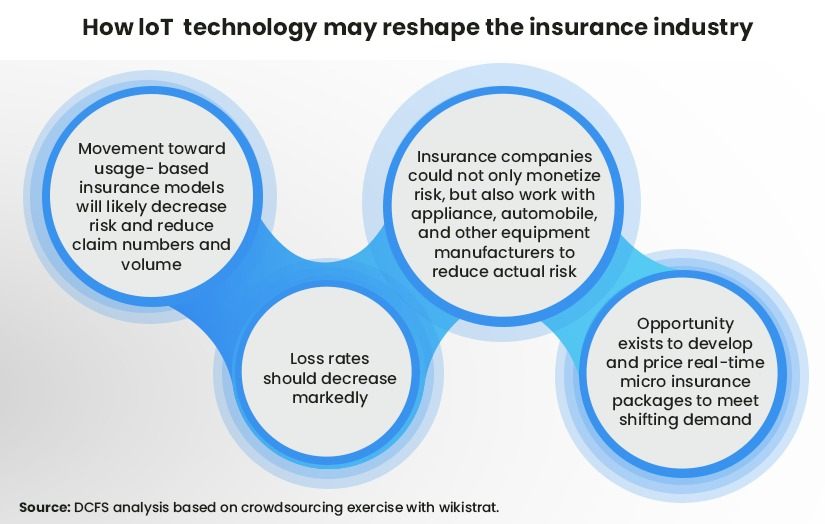

Is there an insurance carrier in the US that is not in the midst of a digital transformation? The risk of falling behind in an economic environment constantly evolving through new disruptive technologies is very real. Disconnected technology is fast becoming a dinosaur. This is why companies all along the insurance chain are closely watching (if not already deploying) the growing opportunities of IoT devices.

The insurance telematics market is on a trajectory to skyrocket from nearly $5 billion in 2023 to an impressive $11 billion by 2028, fueled in large part by the accelerating adoption of telematics, especially in response to the growing number of electric vehicles on the road. Smart homes are also fueling an increasing number of IoT Insurance use cases. The transformative impact of IoT in insurance is all set to revolutionize risk assessment.

Imagine cutting the cost of the claims process by 30%—that’s the kind of impact IoT is having on the insurance industry, according to Forbes. Not only does this technology streamline the claims process, but it could also lead to lower premiums for consumers.

As the insurance landscape undergoes significant evolution, a deeper understanding of the convergence of IoT and insurance telematics is imperative. This journey offers insights into reshaping risk management, pricing strategies, and fraud prevention within the domain of insurance. Join us in navigating the practical applications of insurance IoT.

Also Read: AI for Insurance - Everything You Need to Know

IoT in Insurance Use Cases

Progressive 'Snapshot' Usage-based Insurance

Progressive has been a trailblazer carving out new paths. Way back in 1997, the company shook up the traditional distribution channels for auto insurance by using the internet to bring real-time, online price transparency. The technology might have shaken up the insurance world but 25 years later, it has become a normal standard for every insurance company globally.

Originally, internet communication nodes were so bulky that they were limited to desktop computers. Smartphones and cellular communication opened up a new world where everything was connected - your watch, your Fitbit, and even the tracker on your dog’s collar. The opportunities to use the data that was streaming in from connected devices were endless. Progressive debuted their mobile device UBI application in 2016 but way back in 2008 they introduced MyRate, a usage-based insurance program that customized rates based on how customers actually drove.

Today, Snapshot IoT in insurance products uses either a device installed in your car or a mobile app to measure rapid accelerations, hard braking, miles driven, and time of the day. Driver review periods are generally 75 days and drivers can file new requests to improve their rates.

Over 1.7 trillion driver observations collected thus far are helping the machine learning algorithms to improve pricing accuracy, constantly. In 2020, Progressive altered its Snapshot program temporarily to give drivers low rates during the pandemic, when people stayed home. Imagine, the positive feedback such a quick move generated among its customers.

In Dec 2020, Progressive Corporation offered Snapshot Proview, a fleet management program for small business owners. This joins Progressive SmartHaul which was launched in 2018 that used Electronic Logging Device (ELD) to provide discounts to commercial truck drivers.

Many insurance companies are harnessing the power of IoT for insurance products. Progressive Snapshot, is an IoT insurance use case that shows how this integration redefines savings for drivers. Forbes Advisor Progressive Snapshot review for 2024 reports that on average, users experience an annual savings of $231, contingent upon their performance within the Snapshot program. However, 20% of Snapshot users witness a shift in their rates.

Picked for you: Why Insurance Ecosystems Have Taken on New Urgency in The U.S.

John Hancock “Vitality” insurance IoT

Life insurance heavyweights like John Hancock and even insurance startups like Oscar use wearables to gamify longevity. The former gifts its customers with a Fitbit or an Amazon Halo, they even headlined the Apple Watch introduction, coming on as a partner for the Vitality Program. In 2023 Vitality announced that the price for its most popular life insurance product - ActiveLife - would be directly linked to results from Apple watches worn by its policyholders.

IoT applications in life insurance were an opportunity to incentivize fitness as one way of reducing claims. This was the strategy that powered their launch of Vitality in 2015, partnering with Fitbit. Their CEO, Brooks Tingle puts it most succinctly “People live longer, we make more money”. John Hancock does not shy away from the economic benefits of insurance customers living a long life and they are encouraging them to live it healthily.

Technology is an important foundation that propels the data collected from the wearables to make life-changing insights. The first data sets collected were about physical activity but now sleep tracking is just as important. Nutrition tracking was a difficult data set to work with since it is outside the ambit of wearables, which is why Vitality started on the route of healthy eating discounts, for instance, their policyholders get to enjoy 25% discounts when they buy healthy food at most retailers. Mental wellness was the next pillar to be added and John Hancock incentivized users through a point system for time spent on a meditation app, Headspace.

John Hancock IoT integration is a good example of devices not working in isolation but through a connected network.

Liberty Mutuall’s IoT in Insurance Use Case

In 2020. Boston-based Liberty Mutual Insurance announced its partnership with Ford to offer discounted insurance prices to customers driving a Ford connected vehicle. They joined Tesla and Progressive in providing usage-based insurance. In the case of Metromile, it is the first pay-per-mile car insurance policy.

However, before Usage-Based Insurance, Liberty Mutual had ventured into the IoT realm through Home Insurance. They partnered with Google Nest in 2015 to implement connected smoke alarm devices in insured homes. The advantage for customers was that they got a $99 connected smoke device installed at no cost and also got a 5% reduction on their home insurance premiums once the devices were connected. Incentivizing customers is the best way for insurance companies to make their IoT data integrations successful. The ROI is realized in lower claim applications received.

Also read: Is it important for Insurance Carriers and Agents to have Mobile Apps?

Erie Iot in Insurance - Drone Inspections

It’s a bird. No, it’s a plane. Oh, it’s an insurance drone.

Erie Insurance is a leading example of the insurance industry taking new IoT technology and finding an innovative way to integrate it to improve efficiency. They were the first insurance carriers to get permission from the Federal Aviation Administration (FAA) to deploy drones commercially for on-site roof inspection. A typical one-hour roof inspection was reduced to a mere 20 minutes through their IoT platform.

Chicago-based, All State Insurance has followed suit and is using drones to capture images for property claims. Travel costs which are one of the big outlays are expected to drop because half of the expense comes from adjusters having to drive to the claims site. Also, an adjustor can fit in at least two inspections a day in a traditional on-site inspection. Now with images coming to the adjuster’s desk through the IoT technology, each adjuster can complete up to eight each day.

Some of the other players operating in the Internet of Things (IoT) insurance market are American Family Insurance, Hippo Insurance, and Lemonade Insurance, among others. In insurance, nothing happens overnight, and many insurance carriers haven’t fully ventured into the IoT world. Their journey to implementing an IoT platform might take years, from the first pilots to scaling up. However, IoTs are here to stay and they represent an opportunity as the IoT insurance use cases above make very clear. Insurance carriers will need to look for proven tech players to execute their plans, starting with a platform architecture that can easily integrate with IoT devices to feed the data into business intelligence systems.

Topics: Digital Transformation