Why Insurance APIs and Microservices Are Replacing Legacy Monolithic Platforms

The sun is setting on the legacy monolithic system architecture and while many insurance carriers have migrated to modern microservices-based platforms, not all have. Every insurance business pulls out the strengths, weaknesses, opportunities, and threats for the new financial year. However, in 2024, there is one constant that impacts all four pillars of Albert Humphrey's SWOT analysis techniques - Insurance APIs. Along with microservices-based architecture, the two are standing many of the long-ingrained concepts on their head.

It's only recently that APIs have started to grab the attention of insurance C-suites, spurred by a sense of necessity. Most insurers are looking at long and short-term plans for digital transformation and the architecture to underpin this journey becomes vital. But is it right to say that monolithic systems are on their way out?

Why Insurance APIs Are a Vital Cog in Digital Transformation

Insurance API refers to a set of defined protocols and tools that enable seamless communication and data exchange between different software applications. In the context of the insurance industry, it acts as a bridge, allowing disparate systems to interact, share information, and execute transactions in a standardized and efficient manner. Insurance API integration is pivotal for streamlining processes, enhancing collaboration with partners, and fostering innovation.

Insurance APIs Importance in the Context of Partner Ecosystem Development:

When contemplating the creation of an ecosystem for insurance companies, the initial focus should be on existing partners, often referred to as the "low hanging fruit." The strategy involves identifying the types of interactions that regularly occur with these partners and developing API Insurance integrations to facilitate and standardize these interactions.

By creating open APIs for insurance that generalize common interactions, insurance companies can establish a foundation for seamless collaboration with various internal and external partners. This, in turn, opens up opportunities to expand the partner network or ecosystem. The ultimate goal is not only to enhance operational efficiency but also to drive additional business by capitalizing on the synergies and expertise of diverse partners.

Insurance APIs play a crucial role as connectors, enabling secure and standardized data exchange between insurance systems and the systems of these diverse partners.

Here's a breakdown of typical partnering scenarios that occur within internal insurance functions as well as third-party integrations:

Agents:

-

-

Insurance APIs enable agents to access policy information, quote generation, and claims processing through a unified API.

-

It streamlines agent interactions by providing a standardized interface for data exchange and system integration.

Aggregators:

-

Insurance APIs integrate with aggregator platforms to allow real-time quotes, policy comparisons, and seamless transactions.

Risk Management:

-

Insurance APIs are extensively used to enhance risk management capabilities by integrating external risk assessment services through APIs.

Underwriting:

-

API insurance connectors optimize underwriting processes by offering APIs for quick access to applicant data and risk evaluation tools.

Inspectors:

-

It streamlines inspection data collection and reporting through APIs, improving the efficiency of underwriting processes.

Claim Management:

-

Insurance APIs expedite the claims processing by serving as the middleman between different software for claims submission, status updates, and document exchange.

-

-

Repair/Service Providers:

-

Insurance API-enabled communication is the only way collaboration can happen with repair/service providers for estimates, approvals, and status updates.

-

-

Fintech/Insurtech:

-

Insurance APIs integrate with fintech and insurtech platforms to leverage innovative solutions and data analytics.

-

In essence, Insurance API integration forms the backbone of a well-connected and dynamic insurance ecosystem. It allows insurance companies to leverage existing partnerships, standardize interactions, and lay the groundwork for future collaborations, thereby fostering innovation and driving additional business opportunities within the industry.

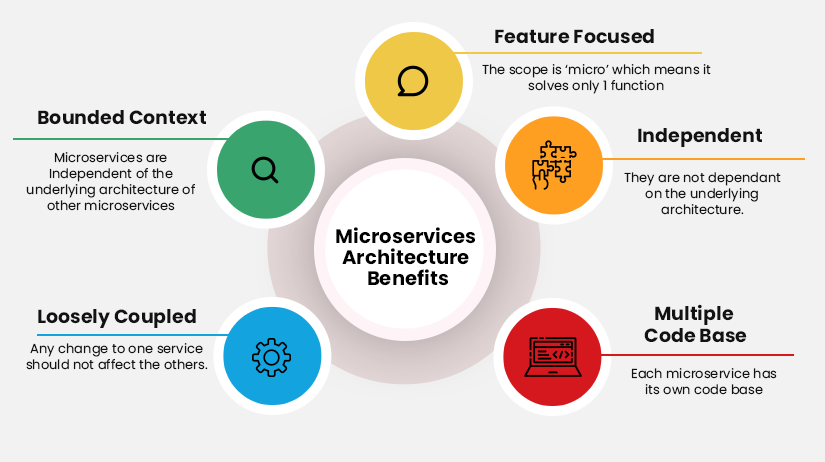

Microservices Cannot Function without API Connectors

A monolithic architecture has been around for a long enough time to be established, understood, as well as trusted. Once this behemoth is in place it is quite scary to consider picking it apart. Having one entity has its benefits but the downside is that if there is a breakdown, the whole system has to be taken offline to discover the cause and fix the issue. And the complexity means that new IT resources taking over are going to find it near impossible to know the system back to front. This is the reason for carriers facing escalating technical costs because fixes are often like a bandaid on a gaping wound.

A distributed system like that of the microservices with multiple modules that communicate with each other through APIs is replacing legacy applications. Further, each module in this open insurance system has its own database. If new functionality has to be added, only that small “chunk” of the module needs to be scaled up. That is the advantage of building microservices, the flexibility to take new features to market at a fast clip to keep in sync with the fast-changing insurance landscape.

The downside of the microservice architecture is that it requires multiple highly specialized internal IT teams or third-party expertise not just to develop and deploy but also in the maintenance and testing of the different microservices. That is why many insurance carriers opt for a single vendor, like SimpleSolve, that takes advantage of the services of other vendors in the ecosystem. The carriers themselves don’t have to manage this.

Also Read: New Policy Management Software: The guide to getting it right

Why traditional insurers are looking at change

Monolithic applications are finding it difficult to keep up with new demands on technology. It is like being trapped inside a bubble while the world outside is rapidly changing. Digital insurance companies like Lemonade, Root and Metromile are relative newcomers to the insurance industry but are breaking new ground through innovative use of technology. McKinsey calls the new digital insurance services “digital attackers” who operate differently from traditional insurers, taking away a share of customers from the incumbents through digital acquisition. These attackers often use external third-party data to develop a competitive pricing model.

The more traditional insurance companies in the US have often tried to reuse their existing architecture in the new digital business model. The problem though is that a massive burden is being placed on legacy infrastructure that was never meant to support it. The digital attackers meanwhile have more modern flexible solutions.

The best route to follow when migrating from Monolithic to Microservices

Although breaking down the existing monolithic applications might seem an uphill battle there are certain ways to make the difficult possible during application modernization.

-

Stop adding new features to the monolithic platform and only fix what is broken

-

Look for components that can be easily pulled out and moved into a microservices platform.

-

Evaluate new requirements coming in and build them as microservices.

-

Slowly chip away at the monolithic framework by beginning on components that are of high value to the business. For example, if usage-based insurance is an important advancement then move the components necessary to support it.

The application programming interface (API) will be the mechanism through which all data will flow to the underlying services. As components are migrated, the monolithic architecture will also need to be modified so that an API proxy will be able to communicate with the monolithic system so that it can continue to perform the services that have not yet been migrated.

At the end of the day, digital transformation requires the creation of microservices to develop great products. And while microservices mean more granularity and hence more moving parts, they are important for creating amazing digital experiences, think IoT for example. Interested in knowing how SimpleSolve can help your organization migrate from a monolithic architecture? Let’s talk.

Topics: Legacy System Modernization