How Insurers Can Secure the Future by Building a Resilient and Intelligent Cloud Infrastructure

The cloud has been one of the most transformative technologies and insurers and their CIOs (chief information officers) are embracing a cloud-first strategy. Gartner says that by 2026, it will exceed 45% of IT spending, compared to a mere 17% in 2021.

Building scale and agility, along with establishing intelligent and trusted cloud infrastructure, are essential aspects of core insurance platforms in America. These factors enable insurance companies to enhance their operations, comply with regulations, ensure security, and achieve business transformation. Let's explore each of these areas in more detail:

Building Scale & Agility With Cloud Technology

According to a global survey, 70% of insurance executives identified scalability and flexibility as the top drivers for adopting new core systems. Scalable platforms enable insurers to handle increased transaction volumes and accommodate business growth effectively.

Insurance companies deal with vast amounts of data and complex processes. Building scale and agility in their core insurance platforms allows them to efficiently handle large volumes of transactions, policies, claims, and customer information. This scalability enables them to accommodate growth, handle peak periods effectively, and streamline their operations.

Agility is equally crucial for insurance platforms as it allows companies to quickly adapt to market changes, implement new products or services, and respond to customer needs. By leveraging advanced technologies and flexible architectures, insurance platforms can enable faster decision-making, automate workflows, and enhance overall operational efficiency. To understand this in practice: An insurance company experiences a surge in policy applications during a promotional campaign. With a scalable core insurance platform, the company can handle the increased volume seamlessly, avoiding bottlenecks and ensuring a smooth customer experience.

To achieve this scalability, will involve insurers follow 3 essential modernization aspects:

-

Migrate from on-premises servers to cloud-based infrastructure or adopt hybrid cloud solutions. It allows insurance companies to scale resources as needed, dynamically allocate computing power, and leverage cloud-native services for increased agility.

-

Adopt microservices architecture: Breaking down monolithic applications into smaller, loosely coupled microservices enables scalability and agility. Microservices can be independently developed, deployed, and scaled, allowing insurance platforms to adapt to changing business requirements more efficiently.

-

Facilitate API integration: Modernizing insurance platforms involves exposing APIs (Application Programming Interfaces) to enable seamless integration with external systems, partners, and third-party services. APIs promote ecosystem collaboration, innovation, and the development of value-added services.

Also Read: New Policy Management Software: The guide to getting it right

Building Intelligent & Trusted Cloud

Intelligent cloud solutions leverage artificial intelligence (AI), machine learning (ML), and data analytics to gain valuable insights from vast amounts of structured and unstructured data. These insights help insurance companies make informed business decisions, identify risks, detect fraud, and personalize customer experiences.

Trust is a critical factor when it comes to cloud adoption in the insurance sector. Insurers need to ensure that their cloud infrastructure meets regulatory compliance requirements and maintains the highest level of data security and privacy. Robust encryption, access controls, data governance frameworks, and adherence to industry standards contribute to building trust in the cloud environment.

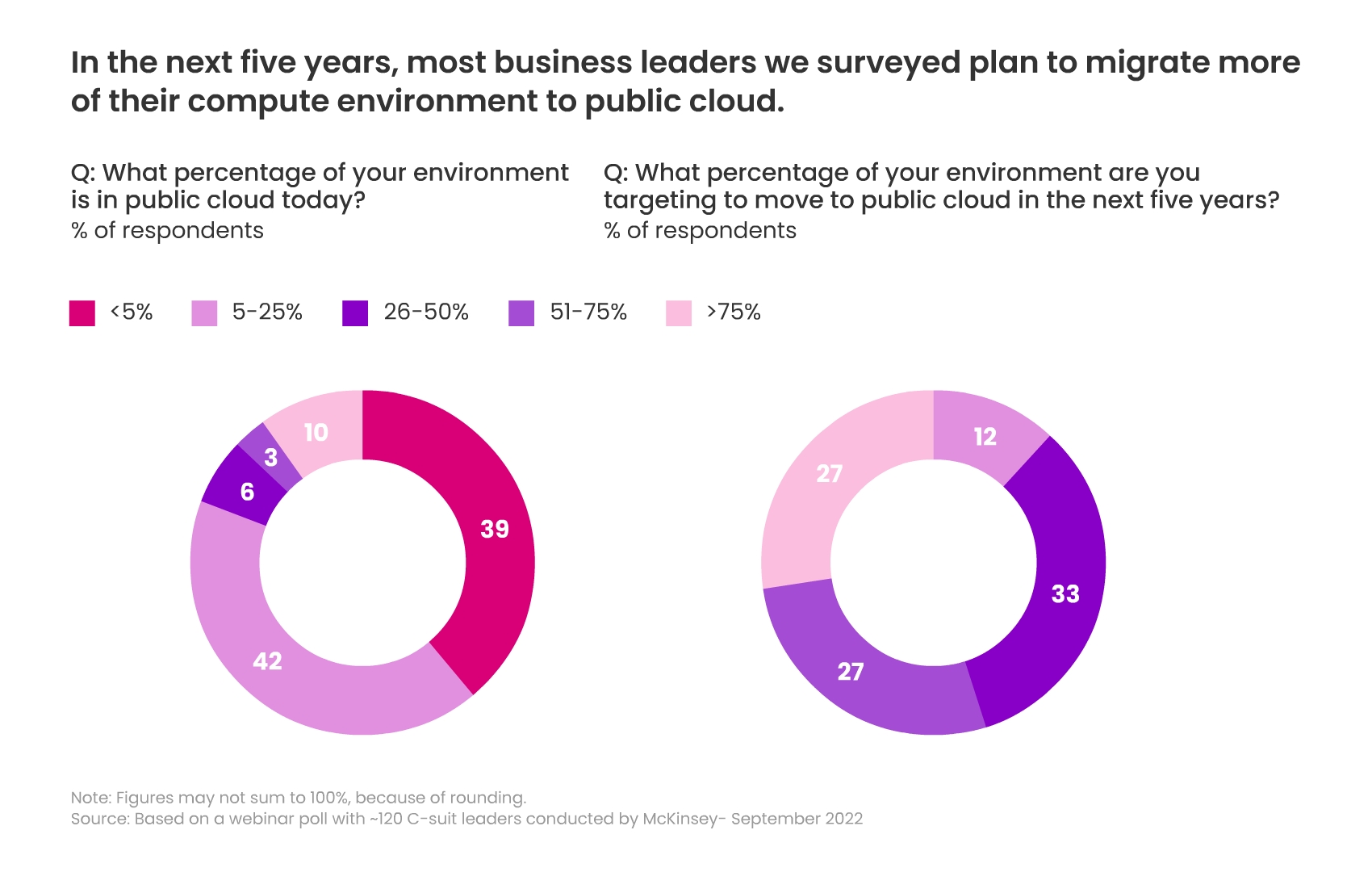

Insurance companies can choose to deploy their core platforms on public, private, or hybrid cloud environments based on their specific requirements and regulatory constraints.

-

Public Cloud: Utilizing public cloud platforms like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) can provide scalability, flexibility, and a wide range of cloud services.

-

Private Cloud: Setting up a private cloud infrastructure within the organization's data centers or through dedicated infrastructure providers allows for enhanced security, control, and compliance.

-

Hybrid Cloud: A hybrid cloud approach combines the benefits of public and private clouds, allowing insurance companies to leverage the scalability of the public cloud while maintaining sensitive data and critical systems within a private cloud or on-premises environment.

More of Interest: Are Insurers Viewing the Cloud as a Cost Saver or an Innovation Driver?

Compliance and Security

Data security is one of the biggest risks of cloud technology, followed by compliance risks and regulatory risks.

Compliance and cybersecurity on the cloud are paramount considerations for insurance platforms. They need to adhere to industry-specific regulations such as HIPAA (Health Insurance Portability and Accountability Act), GDPR (General Data Protection Regulation) or the equivalent CCPA (California Consumer Privacy Act) to protect sensitive customer data. Cloud platforms can assist in achieving compliance by offering features such as data encryption, access controls, audit trails, and security monitoring.

The cloud can provide enhanced security capabilities through features like threat intelligence, automated monitoring, and real-time incident response.

Ensuring the security and compliance of the cloud infrastructure is crucial for insurance core platforms. Consider the following measures:

Data Encryption: Implement strong encryption protocols to protect data both at rest and in transit. Encryption algorithms, such as AES (Advanced Encryption Standard), should be utilized to secure sensitive information.

Access Controls and Identity Management: Implement robust access control mechanisms, including multi-factor authentication (MFA), role-based access control (RBAC), and identity and access management (IAM) solutions, to prevent unauthorized access to the cloud infrastructure.

Cloud-enabled Business Transformation

The adoption of cloud technology enables insurance companies to undergo significant business transformation. It allows them to innovate rapidly, introduce new products and services, expand into new markets, and improve customer engagement. Cloud-based platforms provide the flexibility and scalability required for digital transformation initiatives, facilitating seamless integration with emerging technologies like IoT (Internet of Things) devices, wearables, and telematics.

A study conducted by Novarica found that insurers adopting cloud-based platforms experienced an average of 15% to 25% reduction in IT infrastructure costs. The cloud enables cost savings by eliminating the need for extensive on-premises hardware and reducing maintenance expenses.

By migrating core insurance systems to the cloud, companies can reduce infrastructure costs, optimize resource allocation, and improve operational efficiency. Cloud-based platforms also foster collaboration and data sharing across different departments and stakeholders, leading to improved customer service and streamlined internal processes.

It's important to note that software modernization strategies may vary depending on the specific requirements, legacy systems, and business objectives of each insurance company. The chosen modernization approach should align with the organization's goals and be implemented through a well-defined roadmap and project plan.

Topics: Legacy System Modernization