Leverage Your Data for Intelligent Underwriting and Claims Decisions

Advances in technology are constantly unlocking new sources of data that can help underwriters improve the accuracy of the underwriting process. The most powerful data though could actually be historical data within an organization. Long-standing insurance firms have mountains of policyholder profiles, behavioral information, records of past claims and more, which is first-hand data to base underwriting decisions upon.

Data might be the ‘new gold’ for businesses but like gold, it must be processed before it gets its full worth. Insurance carriers need to direct their investments towards new technologies like AI and predictive analytics tools to gather key insights from them.

Organizational roadblocks to internal data analysis

Building accurate claims analytics models is not just a step towards achieving intelligent underwriting excellence, but can also be critical in setting an insurance carrier apart from the competition. Models that use predictive analytics based on past claims behavior, can significantly reduce processing and approval times, ultimately increasing customer satisfaction. Internally as well, accurate claims analytics models can reduce instances of fraud and increase profitability through more efficient underwriting processes. Making use of internal claims data to build these models comes with two major benefits:

-

Existing data requires less investment than acquiring new sources of data

-

It can be more accurate than third-party sources of information as the data is based on the carrier’s own claims history

So if internal existing data is more cost-efficient and reliable, why aren’t more insurance carriers in the U.S. using it to its full potential? Most often, the reason for this is that the internal insurance data isn’t structured in a usable format. Organizational silos can cause gaps in data and there could be administrative roadblocks to investing in technology that can process large amounts of internal data. Data modernization is essential to realize the huge potential of internal insurance data and gain a granular-level insight into historical claims data.

Bridging gaps through data modernization

Historical data needs to be constantly reassessed to identify outdated information or gaps in the information available. In P&C insurance, for instance, it can be challenging for underwriters to receive all the information they need to accurately evaluate the property or reinsure it. The historical data available might not be adequate or up-to-date. It can also be challenging to update historical data given the volumes that insurance carriers are generally sitting on. This is where new technology can bridge the gap by augmenting available internal data.

Many P&C insurance carriers, for example, are using drone footage or Google Earth images to evaluate the condition of certain properties and add information collected from these new sources to the existing file. The granularity that is possible by combining tech-driven data with historical insurance data can provide insurers with a complete picture of individual portfolios and how they mature over time. It can help underwriters identify very early on whether a specific portfolio is becoming higher risk than initially assessed to be. P&C insurers can also assess the quality of their forecasting by comparing recent images of a property’s roof, for instance, with the initial estimate of the property and its actual condition at present. This can help underwriters understand the accuracy of their methods and identify opportunities to improve them using predictive data.

New Trends: Is Social Media Scoring to Get an Insurance Premium a Good Idea?

Re-thinking traditional organizational structures

To extract tangible insights from internal data, organizations need to take a step back and look at their data in its entirety. Unfortunately, this is often easier said than done. Data within insurance can often be spread across multiple functions. Finance, Actuary, Claims, and Underwriting can each have different pieces of the puzzle. Unless there is seamless cross-department collaboration, it’s unlikely the information will be shared across teams.

So how can organizations improve the visibility of internal existing data? It can come down to just two factors: executive-level support for knowledge sharing and a unified technology backbone.

Departments need to recognize the tangible benefits of collating information within a single repository and the insurance software they work out of needs to enable that. This does not necessarily mean centralizing data but rather building data integration layers to give a unified view. Modern insurance software creates a single user profile that tracks all interactions and engagements a user has had with the company. SimpleSolve’s Client Management feature., for example, with just a single click, allows employees to access the policy details, accounts, claims history, and past interactions with a specific user. Underwriters can get the contact details of any person involved in the policy and get in touch with them instantly. This makes it a truly integrated insurance platform.

Related Read: Can Automated Underwriting Impact the Quality of Your Customer Base?

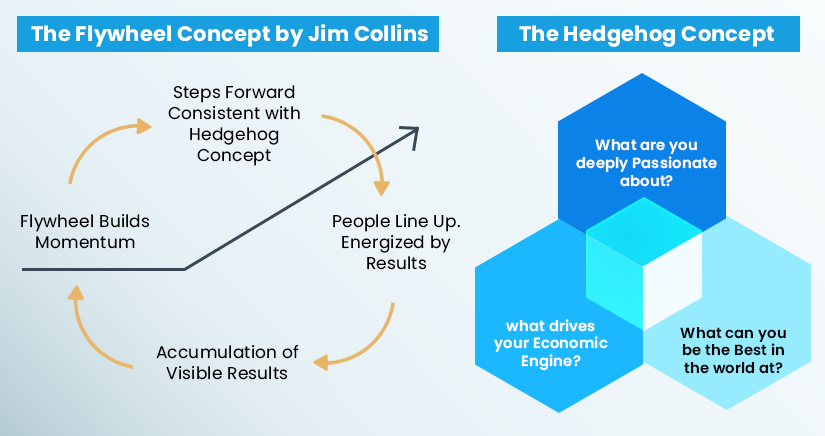

Achieving the Flywheel Effect

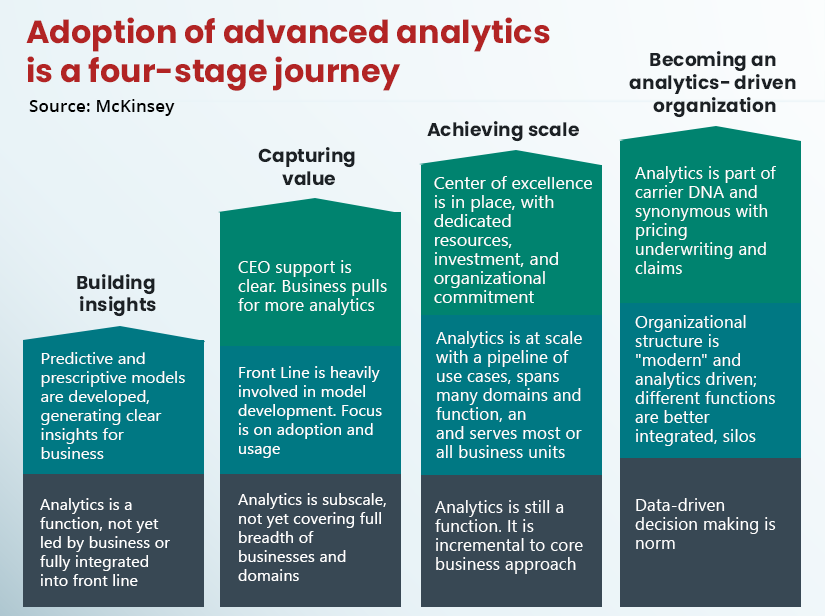

Modernizing insurance data can involve changes in technology, structures, and workflows. From a leadership standpoint, it can also involve significant investments in new features like predictive data analytics. But despite the potential short-term challenges, carriers should persist with modernizing their operations because they stand to gain from a phenomenon known as the ‘Flywheel Effect’.

According to the Flywheel Principle, big changes can often take time to yield results, but there is a certain inflection point after which they start gaining rapid momentum and paying off huge dividends.

Similarly, investing in data modernization and technological upgrades can be intensive, but they can ultimately result in higher profitability, greater policyholder retention, and improved combined ratios.

In one poll, by Intelligent Insurers, almost 76 percent of underwriters surveyed believed that internal claims data is as important as external data. Technological transformation through predictive analytics tools can help insurance carriers achieve underwriting excellence and tangible business benefits by improving the usability of historical data. This will become a powerful differentiator for insurance companies looking to get ahead.

Topics: Digital Transformation

.jpg)