The 4 Disruptive Technologies Leading Digital Innovation in Insurance

.jpg)

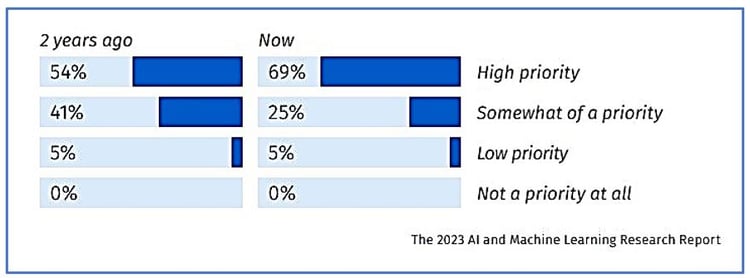

AI/ML technology in the insurance industry is undeniably gaining significant traction, with many insurance companies embarking on their adoption journey. In a 2023 survey of 1420 IT professionals in financial services, government, healthcare, etc. across America, Europe, and Asia, interesting insights were obtained. Surprisingly, nearly one-third of respondents have initiated their AI/ML endeavors within the past year, underscoring the rising importance of these technologies. This stands in contrast to 17% who commenced their AI/ML initiatives two years ago and 11% three years ago.

This is validated by our own experience at SimpleSolve, with more interest generated about our AI-automated SImpleINSPIRE insurance platform. The increasing adoption of AI/ML is fueling disruptive innovation in the insurance industry with tangible benefits.

The impact of AI integration is evident from the 2023 AI and Machine Learning Research report that shows a striking 74% of respondents are already reaping the benefits of AI/ML, with 41% reporting substantial advantages, and an additional 33% attesting to modest gains.

Despite its evident potential, two primary challenges are inhibiting insurance companies from harnessing the power of AI’s disruptive technology: talent shortages and reliance on legacy technology.

Disruptive Technology DefinitionDisruptive technology is a term that characterizes groundbreaking technological advancements or innovations capable of significantly altering traditional business models. Harvard Business School Professor Clayton M. Christensen coined the term in 1997. Within the context of innovation in the insurance industry, disruptive technology introduces novel approaches, products, or services, challenging established norms and redefining the competitive landscape. |

Disruptive technology examples in insurance

To remain relevant in a competitive industry, insurers have no choice but to adapt to the changing times. A disruptive technology example in insurance is IoT technology. Historically, auto insurers used indicators such as age, creditworthiness and past accident records of drivers to determine risk. Now, IoT technology, fitted into smartphones or the vehicle itself, allows insurers to directly monitor driver behavior. This has not only made real-time risk monitoring a possibility but has improved risk analysis in general and balanced pricing for US insurance carriers.

Another disruptive technology example is AI's pivotal role in reshaping risk assessment and underwriting processes. They excel in analyzing extensive historical data and identifying patterns and trends. This empowers insurers to make more accurate predictions regarding potential risks associated with insuring individuals or entities. The result is a shift towards more personalized underwriting decisions and precise insurance policy pricing, aligning premium rates and coverage with the specific risk profiles of policyholders. This application of AI technology in the insurance industry is ushering in an era where insurance policies are tailored to provide equitable, personalized pricing that benefits both insurers and the insured.

Larger insurance companies in America are deploying AI-powered chatbots and virtual assistants for improved customer interactions and support. AI-driven predictive analytics to derive valuable business insights is resulting in the launch of new products and venturing into new markets. However, this monopoly is already changing with the democratization of AI technology provided by AI ecosystem providers. Smaller insurance companies can now access AI tools and platforms at more affordable prices, thanks to the broader availability of AI solutions. This allows them to compete with larger insurers without prohibitive costs.

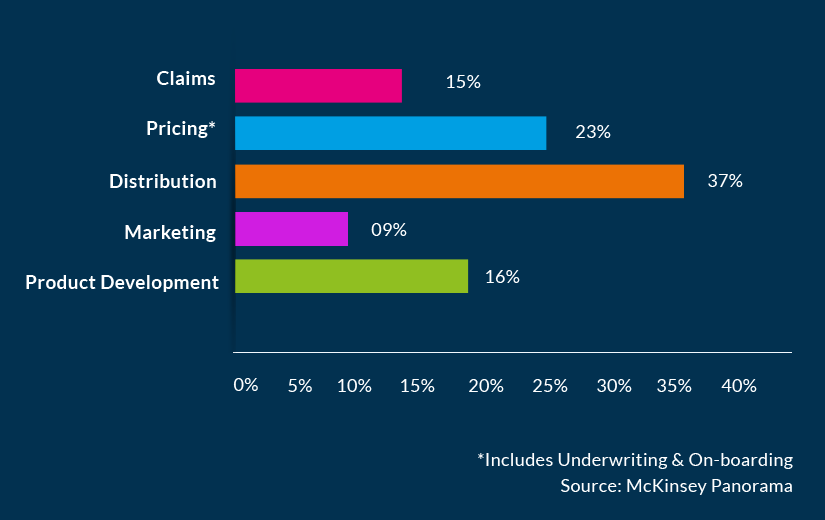

Penetration of digital innovations across the insurance value chain

Disruptive technologies to watch out for

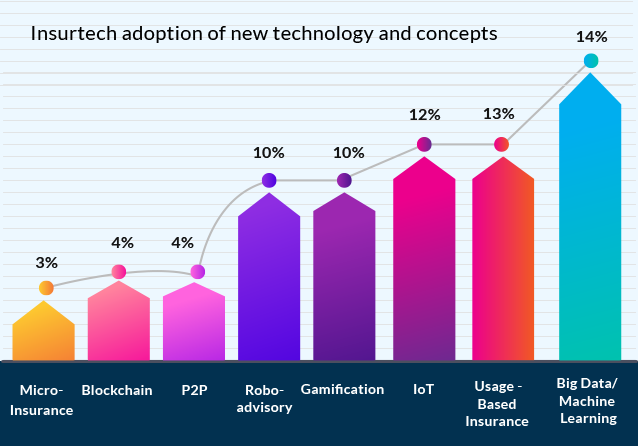

Going by the trends in the industry, there are four technologies to watch out for that are transforming the way the insurance industry functions and are likely to disrupt the sector even further in the coming years.

1. Big data and analytics

The most important asset for insurers is data. Insurance companies have to chew through hoards of consumer and commercial information to make important decisions. For an industry that is so heavily dependent on these data points, the rise of big data technologies has been a disruptive force. For instance, predictive analytics that uses big data can accurately compute pricing and risk selection, reduce underwriting costs, improve claims triage and even catch on to emerging trends.

A Willis Towers Watson survey among U.S. property and casualty insurers found that over 90% of those surveyed felt that predictive models had a positive impact on rate accuracy, loss ratios and profitability.

In the coming years, technology tools will grow more sophisticated to maximize the efficiency, speed and accuracy of big data outcomes. Personalized policies, targeted marketing and even fraud detection will be enhanced in ways never envisioned.

2. Machine learning, artificial intelligence, generative AI

Machine learning, artificial intelligence technology and intelligent automation are the most disruptive technologies in the insurance industry today. In the past few months, they have been joined by Generative AI applications. AI and machine learning allow computer systems to continuously learn and evolve. Not just that, their ability to closely mimic human capabilities, and do it more accurately, creates unimaginable opportunities for disruption in insurance.

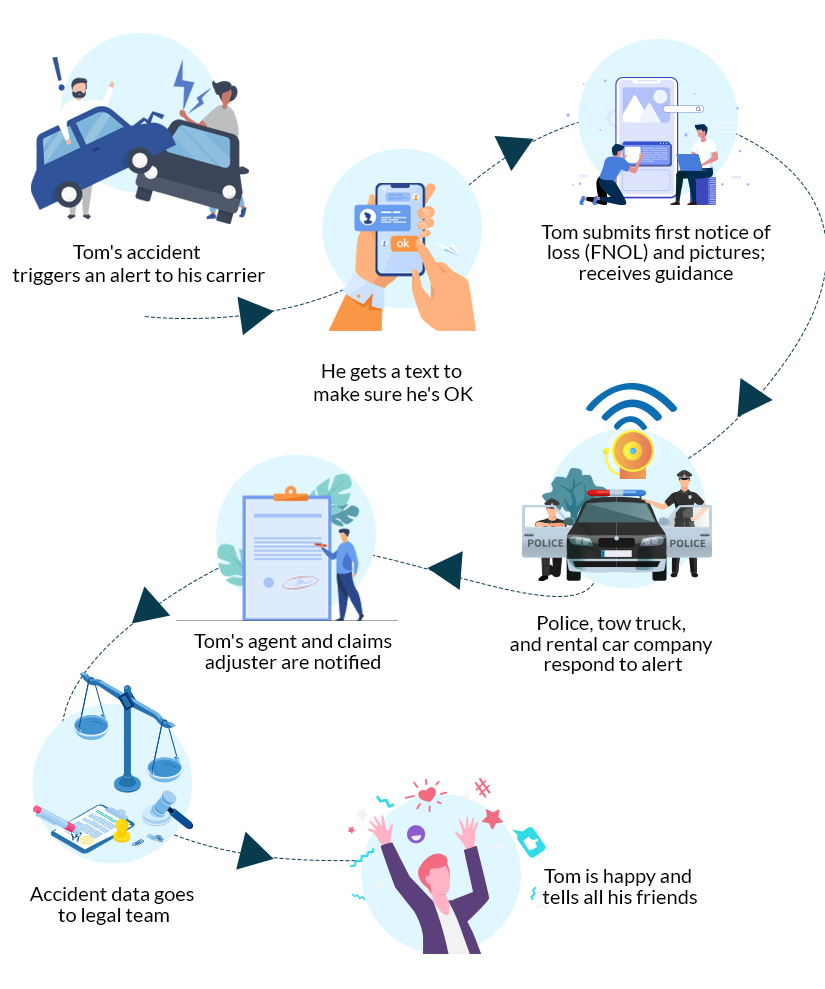

AI and RPA have increased automation possibilities in claims processing in the P&C and employee insurance sectors. One example is the usage of machine learning algorithms for fraud detection to spot anomalies that even the most-trained humans could miss. More and more companies are adopting mobile-based AI technology for fraud surveillance and prevention, claims process and overall process efficiency.

The emergence of generative artificial intelligence (AI) is one of the most talked about innovations in the insurance industry. Generative AI in the insurance industry is an exciting development powered by advanced algorithms and deep learning techniques. This innovative technology has the remarkable ability to create new content, insights, and solutions - areas that till recently were considered to be possible only by humans. The exciting part is that it can give responses based on instructions provided to it in everyday English.

As insurance companies explore the potential of generative AI, it's opening new doors to enhance various aspects of the industry.

- Generative AI-driven chatbots have the potential to provide personalized advice and recommendations based on customer profiles and histories, enhancing customer satisfaction and loyalty.

- Generative AI can learn from the details of large volumes of data of past insurance claims, including why claims were either accepted or rejected. Using this it will be able to predict future claim outcomes based on these principles

Insurers have only just begun to scratch the surface of what ML and AI technology can do for the insurance process. We can only wait and watch to see what kind of transformations are in store using these technologies in the future.

Also read: 6 Ways Machine Learning and AI are Transforming the Insurance Industry

3. IoT technology is a proven technology trend in the Insurance industry

Internet of Things or IoT technology refers to the network of interconnected, wireless objects that allow data transfer and processing without human intervention. Telematics is a branch of IoT that combines telecommunications and informatics that allow the flow of information.

Combining these two technologies has been groundbreaking for the insurance industry. From GPS-enabled monitoring devices to wearables, IoT technology and telematics allow real-time risk monitoring that has been extremely useful for auto, P&C and even health insurers. For instance, John Hancock, one of the oldest North American life insurers, now sells interactive life insurance policies. In exchange for incentives like rewards and discounts, an insured’s health and fitness data are monitored through Fitbits and smartphones. This ensures that customers are healthy, thereby reducing their chances of falling ill and therefore, lowering claims filed.

Telematics: Increasing opportunities in product innovation

IoT technology can be a game changer, completely transforming the disruptive technology meaning for insurers, especially in the personal insurance industry. Integrated technology can make data access more accurate and real-time, thereby improving the efficiency of the entire insurance process.

4. Pioneering disruptive technology example: Blockchain

Changes to IT and data architecture can have a considerable impact on digitized insurance. For example, transitioning to cloud technology can enable efficient and cost-effective data storage.

Research indicates that 7 out of 10 insurers have adapted cloud technology for better speed, scalability and efficiency in handling insurance data.

Newer technologies like blockchain or distributed ledger technology also have immense potential in future. Some industry experts have compared the potential of blockchain technology to the internet in its ability to transform industrial practices. Blockchain in insurance can bring about greater security, fraud mitigation and efficiency for different insurance sectors. PwC estimates that blockchain technology can lead to $5-$10 billion in cost savings for reinsurers.

Also read: Are We Moving to a Blockchain-Powered Insurance Industry?

Digitization in insurance: Moving forward

Digital innovation and disruptive technologies like predictive analytics, AI and cloud computing are here to stay. In the years to come, as systems and things get even more connected digitally, insurers will have to break away from traditional legacy systems to embrace digitized insurance wholeheartedly.

A fully integrated enterprise insurance software, such as SimpleINSPIRE, provides the ability to leverage smart automation, AI/ML workflow and IoT technology. To begin on this process of modern digitization in insurance, speak to our AI experts, today.

Topics: Digital Transformation